Friday December 4, 2015

Economic Calendar & Watch List 12/4/2015

Morning Notes

US futures are slightly higher this morning after yesterday’s sharp sell off. European markets are trading lower by over -.5% after the ECB did not follow through with expanding QE. The market awaits November Non Farm Payrolls report to gauge the strength in the labor market. Asian markets closed mostly lower.

Technicals

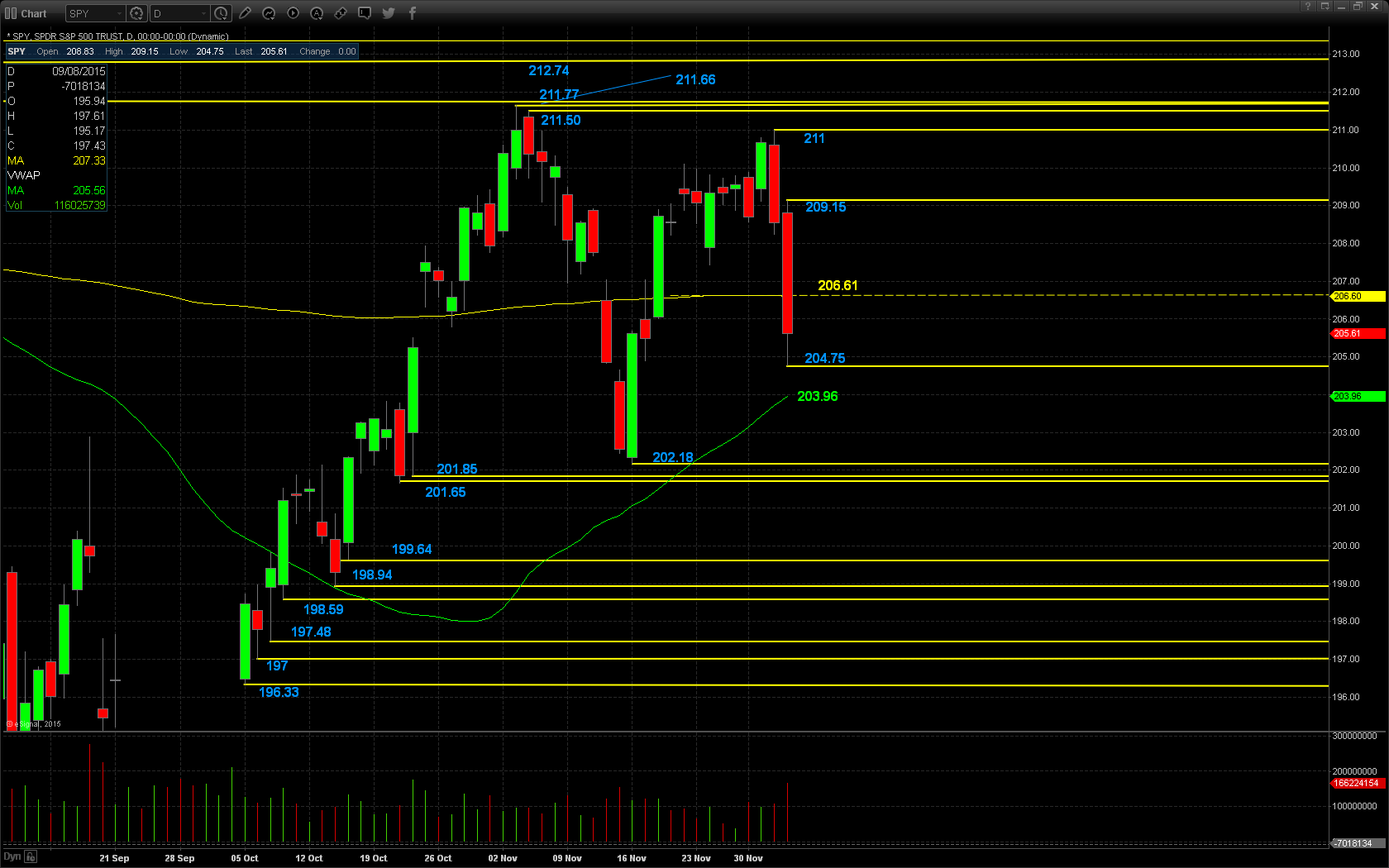

The SPY traded sharply lower in yesterday’s session and closed below the 200 day moving average. Support will lie at the low of yesterday’s range at $204.75, followed by the 50 day moving average at $203.96, and then $202.18. Resistance will first lie at the 200 day moving average at $206.61, followed by the high of yesterday’s range at $209.15 and $211.

Small Cap Watch List

*Please refer to the momentum scanners displayed live in the chat room for potential plays at the market open.

**Others On Watch**

AMBA – 4Q Rev., Profit Forecasts Trail Ests.; 3Q Beats

NSC – Rejects Offer From Canadian Pacific

ULTA – 3Q EPS, Rev., Comp. Sales Beat Estimates

Economic Calendar

| 8:30 Nov non-farm payrolls expected +200,000, Oct +271,000. Nov private payrolls expected +190,000, Oct +268,000

8:30 Nov avg hourly earnings expected +0.2% m/m and +2.3% y/y 8:30 Oct trade balance expected -$40.50 billion 10:15 Philadelphia Fed President Patrick Harker speaks 3:45 St. Louis Fed President James Bullard speaks 4:00 Minneapolis Fed President Narayana Kocherlakota speaks |

Notable Earnings Before Open

BIG: Big Lots – EPS Est. $(.005) Rev Est. $1.12B

HOV: Hovnanian – EPS Est. $.09, Rev Est. $739.45M

Notable Earnings After Close

NONE