Gap and GO! Day Trading Gap Strategy

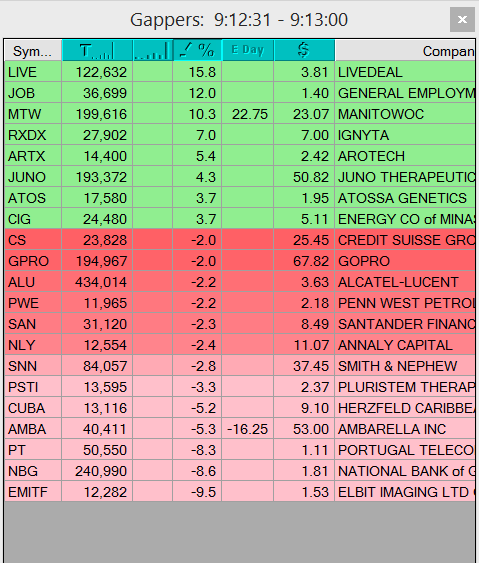

Learning a Strategy for Day Trading the “Gaps” or “Gappers” is critical for success in the market! I trade a Gap and Go! Strategy. Everyday I start the same way. I look at the gappers that are more than 4%.

Gaps of more than 4% are good for Gap and Go! trading, Gaps of less than 4% are usually going to be filled but I don’t find them as interesting. I look for the quick and easy trades right as the market opens. Gap and Go! is a quick day trading strategy to give us a profit usually by 10am.

The big question new traders will ask is how do I find stocks that are good candidates for a Gap and Go?

Gapper Checklist

1) Scan for all gappers more 4% using Trade-Ideas scanners

2) Hunt for Catalyst for the gap (earnings, news, PR, etc)

3) Mark out pre-market highs and high of any pre-market flags, a good gap will hold the top of the gap, a bad gap will be selling off pre-market.

4) Prepare order to buy the pre-market highs once the market opens.

5) At 9:30am as soon as the bell rights buy the high of the first 1min candle (1min opening range breakout) with a stop at the low of that candle or buy the Pre-Market highs.

Here is another question many traders ask. Why do these squeeze at the open when they are already gapping up so much?

Retail traders see the big % gap, notice the catalyst, and want to jump in on the confirmation of a breakout. Often these stocks have just reported great news and even thought it’s chasing to buy a stock up 10% they can continue to run another 10% or more in the first 30 min.

Anyone who is short will cover their position while long biased retail traders jump in for the squeeze. We have seen stocks open at $8.00 and close at $20.00. Just because we gap up 50% doesn’t mean we can’t run 100%. We have to focus on trading the chart. If they chart says hold on we’ll hold on. When the chart says sell, we’ll sell.

Combining Fundamental and Technical Analysis

When we have a stock that is breaking out it’s almost always due to a fundamental catalyst. News, earnings, etc. We apply this fundamental catalyst to our interpretation of how the stock could perform today.

We must review the technical of the daily chart. Are there areas of near by resistance? Are there ares with big triggers? We must combine technical and fundamental analysis at the open to make sure each of our setups have big potential.

The Importance of Float

Always look for low float stocks. These will have home run potential written all over them. A stock that has a 10mil share float and trades 1mil share pre-market has already traded 10% of the float.

There is an extremely good chance the entire float will be traded during the day once the market is open. These are the type of stocks that can run 50-100% in one day. When we have the right catalyst, float, and retail trader interest, it’s the perfect storm for a big runner.

It’s very important to remember that while the Gap and Go strategy works 75-80% of the time when I’m trading it, I’m very cautious to only take the best looking gappers.

Some days we won’t have any stock that is gapping up due to a catalyst. In those cases, the best thing to do is sit on our hands and wait for a better setup tomorrow.

Check out our Watch Lists to see how I analyze the gappers.

Gap and Go Rating System for our Watch List

A Quality Characteristics

Float less 20mil shares

Short Interest greater than 10%

Good Catalyst (news, earnings, etc)

Former Runner

Hot Stock with lots of Retail Interest

Pre-Market volume above 150k shares

B Quality Characteristics

Float between than 50-100mil shares

Short Interest between 5-10%

No Catalyst beyond technical breakout

Less than ideal Sector (manufacturing, oil, consumer goods)

Not a hot stock or former runner

Price greater than $20.00

Pre-market volume less than 100k

C Quality Setup

Float greater than 100mil shares

Short Interest less than 5%

No Catalyst

Former Pump and Dump stock

Very small gap less than 4%

Less than 50k pre-market volume

$ATOS nice clean Gap and Go Setup

$CONN Gap and Go

$CSIQ really nice gap with pre-market flag at 23.60, bought this at 23.60 and rode the wave up to 25.00, what a nice move.

$MTSL beautiful Gapper with pre-market high of 1.94. Bought the breakout and sold on the spike up through 2.30 for an 11% move in less than 1minute. Picture perfect!

$NVGN nice gap pre-market with a low float stock, bought the pre-market flag at 2.70, then bought the first pull back at 3.00, skipped the 2nd pull back at 3.13 but that would have been a nice one too!

Final Thoughts

The gap and go strategy is a great strategy to learn even if you are just starting your trading career. This is the type of setup that you can find everyday that has huge potential and the ability to manage your risk responsibly.