AVEO Pharmaceuticals Inc. (NASDAQ: AVEO)

AVEO Pharmaceuticals (AVEO) a biopharmaceutical company in the cancer field today announced an exclusive license agreement with Novartis for the development and commercialization of AV-380.

AVEO Pharmaceuticals Earnings and Outlook

AVEO ended Q2 2015 with $26.8 million in cash and cash equivalents. Total collaboration revenue was approximately $0.1 million compared with $1.8 million for Q2 2014. The decrease was primarily due to an additional $1.8 million in revenue recognized in connection with our agreement with Astellas, which concluded in August 2014. Research and development (R&D) expense was $1.8 million compared with $9.3 million for Q2 2014. The decrease in R&D expense was primarily due to a reduction in personnel-related expenses following our January 2015 strategic restructuring, the reduction of our leased facilities, as well as a decrease in external clinical trial and consulting costs associated with the decreased tivozanib clinical development activity and AV-380 preclinical development activity. Net loss for Q2 2015 was $5.5 million, or a loss of $0.10 per basic and diluted net loss per share compared with net loss of $18.0 million or a loss of $0.35 per basic and diluted net loss per share for Q2 2014. Business Wire

AVEO Pharmaceuticals CEO’s Comments

CEO on license agreement with Novartis of AV-380:

“AV-380 holds great promise as a potential treatment for cachexia secondary to multiple disease states, including cancer, chronic kidney disease, congestive heart failure and chronic obstructive pulmonary disease,” said Michael Bailey, AVEO’s president and chief executive officer. “Novartis brings resources and expertise to bear on advancing this program, which we believe provides the optimal path forward toward realizing its full potential.” Business Wire

CEO comments on Aug 10 regarding second quarter financial results:

“The second quarter was productive on multiple fronts for AVEO, including clinical updates, regulatory guidance and another partnership for tivozanib, in addition to completion of our corporate streamlining efforts,” said Michael Bailey, president and chief executive officer. “These accomplishments have positioned us well to continue pursuing several additional value creating initiatives for tivozanib, including a potential confirmatory clinical and regulatory path forward for renal cell cancer in the US, as well as a potential marketing authorization application for renal cell cancer in Europe. We remain focused on executing against these goals as we continue to evaluate additional portfolio partnerships and further tivozanib development in colorectal cancer, throughout the balance of the year.” Business Wire

Technical Analysis

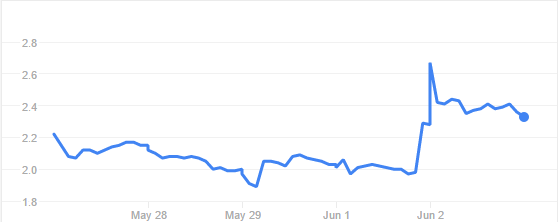

AVEO gapped up today in price to $2.46 up from yesterday’s close of $1.17 which is a 110% increase in price based on favorable news. Taking a look at the daily chart we can see the 52 week high for the stock was $3.50 reached on May 21. The highest close price for the year was $2.49 which was reached on June 4. With a 52 week low of $0.61 and the stock trading at $1.17 yesterday and today’s gap up to $2.46 we can see the stock has been very volatile for a small cap stock. The stock did reach pre market highs of $2.97 today so it gave back $0.51 at the open, which would make me a little cautious thinking the stock may be over extended at these levels. For trading purposes my entry point would be at $2.65 which would give me a little confirmation that the run up will continue. My stop loss would be the gap up price of $2.46 fearing anything below that and we can fill in the gap up.

Company Profile

AVEO Pharmaceuticals, Inc., a biopharmaceutical company, develops targeted therapies for patients with cancer and related diseases. Its product candidates under development include Tivozanib, an tyrosine kinase inhibitor for various vascular endothelial growth factors; Ficlatuzumab, a hepatocyte growth factor inhibitory antibody, which has completed Phase II trial; and AV-203, an anti-ErbB3 monoclonal antibody that has completed a Phase I dose escalation study. The companys development programs also comprise AV-380 Program, a humanized IgG1 inhibitory monoclonal antibody for the treatment or prevention of cachexia, which is a multi-factorial syndrome of involuntary weight loss associated with various cancers and diseases outside of cancer. It has strategic partnerships with Ophthotech Corporation; Biodesix, Inc.; St. Vincents Hospital Sydney Limited; Biogen Idec Inc.; and Kyowa Hakko Kirin. The company was formerly known as GenPath Pharmaceuticals, Inc. and changed its name to AVEO Pharmaceuticals, Inc. in March 2005. AVEO Pharmaceuticals, Inc. was incorporated in 2001 and is headquartered in Cambridge, Massachusetts. Yahoo Finance