Momentum Day Trading Strategy

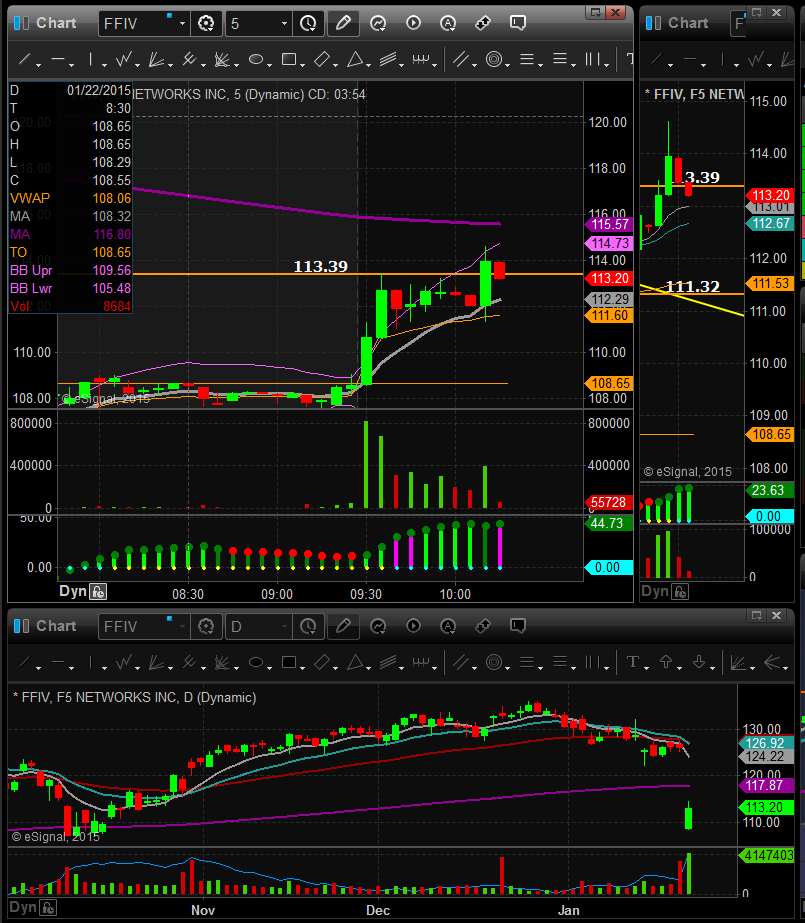

For momentum day trading strategies I only trade stocks on strong upward or downward trends. These stocks are easy to find using the scanners I have developed with Trade-Ideas. My Surging Up scanners immediately shows me where the highest relative volume in the market is. I simply review scanners alerts to identify the strong stocks at any given time of the day. As a pattern based trader, I look for patterns that support continued momentum. Scanners alone cannot find patterns on charts. This is where the trader must use their skill to justify each trade.

When I see a stock that has extremely high volume I look to get in on the first or second pull back. Pull backs should take the form of a Breakout Chart Pattern such as Bull Flags or Flat Tops.

Stocks on the Surging up Scanners that are candidates for the Momentum Trading Strategy can be traded as early as 9:35. Sometimes a stock that wasn’t gapping up and already on my radar for a Gap and Go! Strategy trade will surge with volume out of the gates and come into play for a Momentum Trade. These stocks may have news or may be experiencing a technical breakout or be a sympathy play to another strong stock or sector.

The Momentum Trading Strategy can be used from 9:35-4pm. Any time during the day we can get a news spike that will suddenly bring a tremendous amount of volume into a stock. This stock which was of no interest earlier in the day is now a good candidate to trade on the first pull back.

Patterns I look for in Up Trends

Momentum Day Trading Strategies Pattern: Rising or Ascending Wedge

Momentum Day Trading Strategies Pattern: Rising Rectangle

Momentum Day Trading Strategies Pattern: Bull Flags

Patterns I look for in Down Trends

Momentum Day Trading Strategies: Falling or Descending Wedge

Momentum Day Trading Strategies : Falling Rectangle

Momentum Day Trading Strategies: Bear Flags

Where to set my stop?

When I buy momentum stocks I usually set a tight stop just below the first pull back. If the stop is further than 20 cents away, I may decide to stop out minus 20 cents and come back for a second try. The reason I use a 20 cent stop is because I always want to trade with a 2:1 profit loss ratio.

In other words, if I risk 20 cents, it’s because I have the potential to make 40 cents. If I risk 50 cents or more, it means I need to make 1.00 or more to get the proper profit loss ratio to justify the trade. I try to avoid trades where I have to generate a large profit to justify the trade. It’s much easier to achieve success if I have a 20 cent stop and 40 cent target vs a 1.00 stop and a 2.00 profit target.

How to determine position size?

I try to balance my risk across all trades. The best way to calculate risk is to look at the distance from my entry price to my stop. If I have a 20 cent stop and want to keep my max risk to $500 I’ll take 2500 shares (2500 x .20 = 500)

Entry Checklist:

1. Momentum / Breakout or Breakdown Day Trading Pattern

2. You have a tight stop that supports a 2:1 profit loss ratio

3. You have above average volume. High Relative Volume is extremely important. Heavier volume means more people are watching

4. Low Float is preferred. I look for under 100million share floats.

Exit Indicators:

1. 1min or 5min candle closes against the direction of the trade (depending on which chart the pattern is forming on)

2. Extension bar forces me to begin locking in my profits before the inevitable reversal begins.

Summary:

Trading Momentum is what day trading is all about. There is always momentum in the market, we just have to find stocks moving. Stocks Scanners alert me to the strong stocks. I then review the chart and try to get an entry on the first pull back. Most traders will buy in this same spot. It’s risky to chase stocks so professional traders will instead wait for pullbacks to get in. This allows for proper risk management. By having a profit/loss ratio of 2:1, I can trade successfully with only a 50% success rate. This gives me a great deal of confidence because I only need to win every other trade I enter. The most important key to success in this strategy is following it strictly. Always look for high relative volume!