Twitter (TWTR) Goes Splatter

Today, April 28, 2015 shares of Twitter, (TWTR-NYSE) – an online social networking service that enables users to send and read short 140-character messages called “tweets”., fell precipitously in active trading that began suddenly after a known twitter account posted stated earnings that were due to be reported by Twitter after the close of trading this afternoon. The twitter account, SELERITY, regularly posts on various companies earnings, breaking news, mergers and acquisitions, etc. Before any news from the company or actions by trading activity regulators, Twitter stock began to make new intra-day lows on increasing volume. Then, Regulators halted trading trapping anyone with any position in Twitter- be it stocks or options. A trading halt is something that regulators can impose to effectively allow markets to sort themselves out and for buyers and sellers to be matched so there is no collapse in the equity of that stock.

LEAK ? or Company Website Error

While most investors and traders thought this to have been a leaked document, it seems the information may have been already available on the Twitter Investor Relations Site, according to SELERITY.

During the time of a trading halt no one can exchange shares in the open market at all, so people who owned Twitter could not sell and people who wanted to buy Twitter on a lower price could not buy; this creates much anxiety and fear in not only the specific stock but also amongst other stocks in its sector (think Facebook: FB: NASDAQ): .When shares reopened for trading the stock plummeted down nearly $11.00 before support buyers began to line up and buy shares.

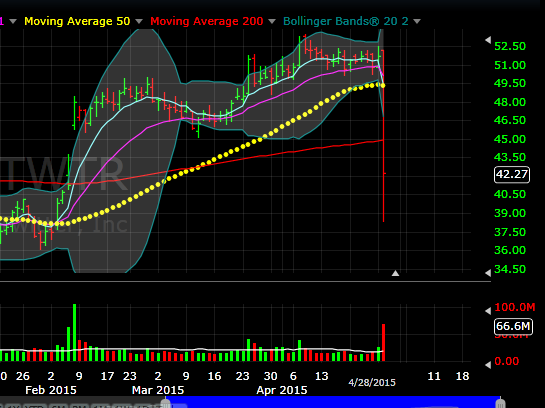

Below are two stock chart examples of today’s action – #1 being the five minute intraday candlestick stock price and the other -# 2-being the daily chart showing OHLC in the past 45 days. If you look on the daily chart in February you will see a space where one bar was and then another bar begins much higher. This is called a stock price gap.Gaps occur for many reasons (a totally different topic of discussion for a later article), but according to statistics when a stock price gap is observed, by a chance of 91.4% it will get filled in the future. In layman’s word, 9 in 10 gaps get filled; not always, but pretty close. ( as Twitter did today).

Twitter eventually found Support at around the $38.38 level and traded up slightly to $44.20 in heavy trading before closing at $42.27.

Earnings-The Numbers

Twitter did reports earnings and they were mixed. The company posted a loss of $162 million, or 25 cents per share, in the January-March period. That compares with a loss of $132 million, or 23 cents per share, a year earlier. Adjusted earnings were 7 cents per share. Analysts polled by FactSet were expecting 4 cents.

Wednesday’s Trading

There is no question that volatility in tomorrow’s trading action will be abnormal and very dangerous for the average person looking to make a fast profit,but speculators and intelligent daytraders will be showing up to the table tomorrow when Twitter opens at 9:30 am in New York for trading.