Airlines Mayday Call

Shares of nearly every major airline company took a severe hit and fell back to Earth today Wednesday May 20, 2015 in heavy active trading in US and world markets. All the familiar names: United Airlines (NYSE:UAL), Delta (NYSE:DAL), JetBlue (NASDAQ:JBLU), Southwest (NYSE:LUV), American (NYSE:AAL), and Spirit (NASDAQ:SAVE) experienced losses from at least 6 % to more than 10%. Selling was widespread, heavy and worrisome for investors holding positions in any of these stocks.

What was particularly unsettling was the fact that many of these stocks gave up price growth and profits that they accrued going back as far as September or October of 2014 while simultaneously losing their price support level of the 200 moving day average which is a very key level that many long-term investors, money managers, hedge funds and mutual funds use as a gauge when deciding whether to own a stock or sell a stock.

While there did not seem to a specific news event which caused this sell-off, some think it may be attributed to the fact that oil prices have begun to drift higher again after an enormous price decline along with a downgrade on Southwest Airline stock. Airlines growth may have peaked this year ending a multi-year run that the airline industry has enjoyed for the past 5-7 years.

Speaking at an industry conference hosted by brokerage firm Wolfe Research, a boutique that focuses on transportation, Southwest chief financial officer Tammy Romo said that this year may be a “peak” for the airline industry’s growth. One factor that has been mentioned in various places is that some involved in the airline industry have decided to take advantage of the strong travel market right now by increasing their utilization capacity. Meaning, lowering prices, upping cabin capacity, increasing routes served, and increasing number of planes which could lead to heavy industry battle for customers.

Jim Cramer stated, “If you’re engaged in a dogfight for customers, the customers will win, but your shareholders might lose.”

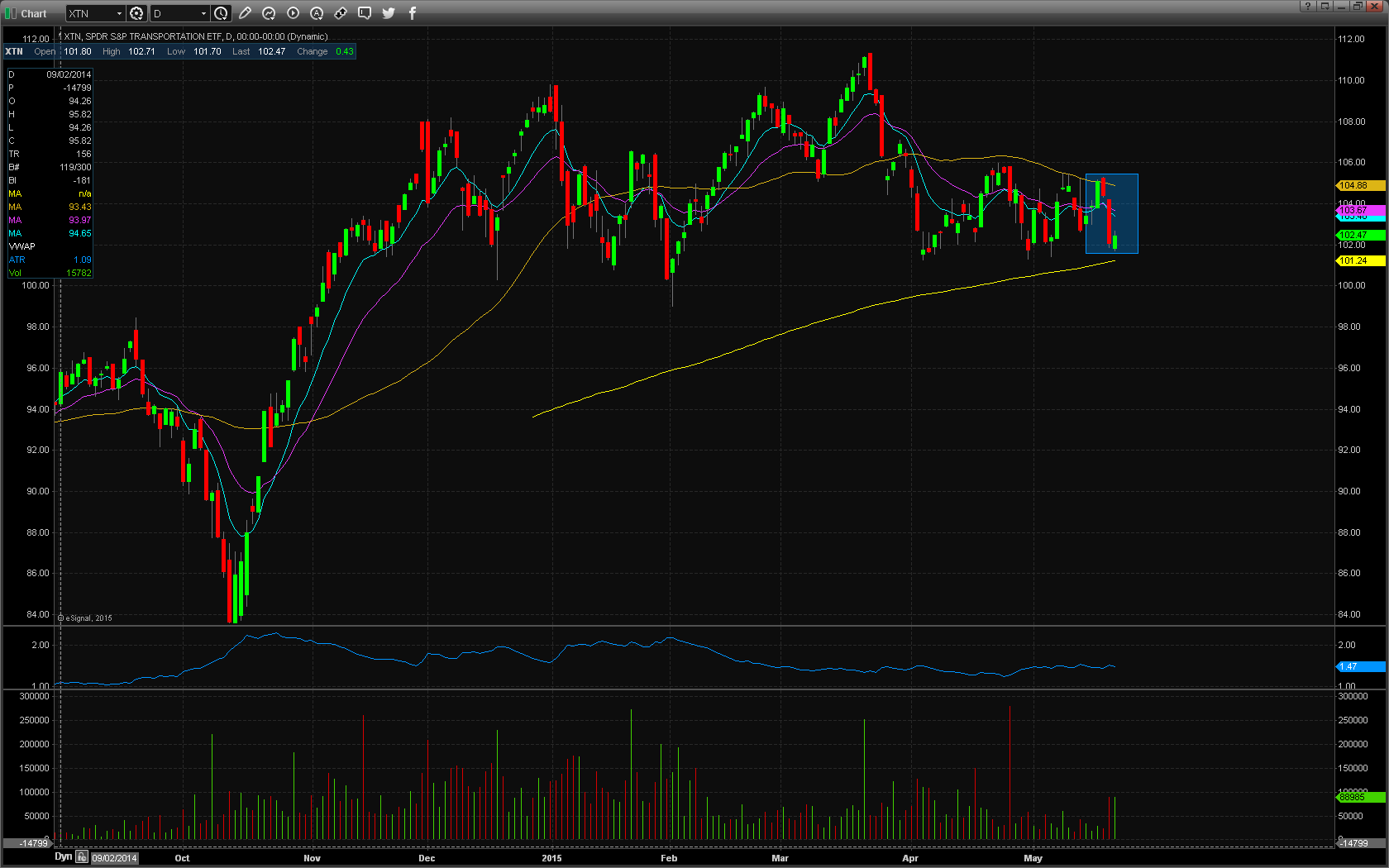

Explosive Chart

Please see above the monthly chart of Southwest Airlines (NYSE:LUV), arguably one of the most profitable airlines in business recently. The stock has gone from roughly $7 to $47 from 2009 to the present. That is nearly a 700% increase in 6-1/2 years!