International Business Machines Corporation (NYSE: IBM)

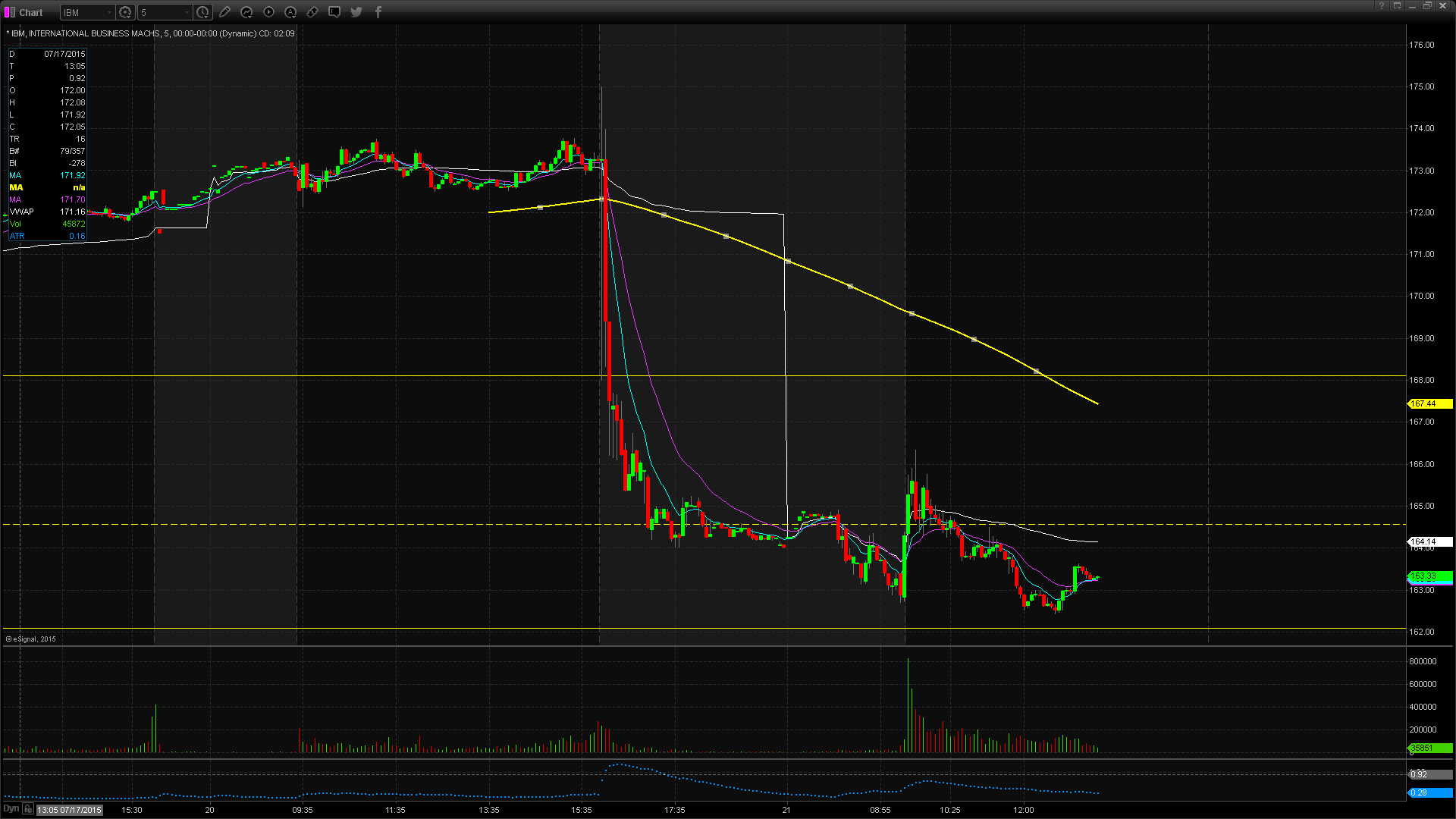

IBM stock is sliding lower by nearly 6%, or -$10.25, after disappointing second quarter results were released late Monday. IBM reported net income of $3.4 billion, or $3.5/share on 20.8 billion in revenues which was a 13.5% decline from a year ago. In addition, the company’s profit also saw a significant decrease of 16% all attributed to sluggish pc demand.

CEO Comments

Chief Executive Officer, Ginni Rometty, commented on the second quarter earnings:

“Our results for the first half of 2015 demonstrate that we continue to transform our business to higher value and return value to our shareholders.”

Analysts On IBM

Wamsi Mohan, an analyst for Bank of America Merrill Lynch sticks to his $170 price target and a neutral rating while making the following comments:

Slightly below Street 2Q revenue, and lower Services margin hurt IBM operating results. But EPS beat on below line items. IBM maintained 2015 guide, but below Street 3Q creates dependence on 4Q results. We model below guide on FX and weak software. During the quarter, GTS was up 1% Y/Y in CC, GBS declined 3% Y/Y, Hardware increased 5% while Software declined 3% Y/Y.

Brian White, an analyst for Cantor Fitzgerald, remains very bullish on the outlook for IBM with a $198 price target and a buy rating. He also commented on the earnings release:

Given skepticism around this turnaround and continued negative sentiment around IBM, the stock is trading at just 10.6 times our 2016 EPS estimate with an attractive 3% dividend yield and our model continues to suggest IBM’s sales cycle bottomed out in the second quarter of 2015 (and operating profit cycle bottomed in the fourth quarter of 2014).

About International Business Machines Corporation

International Business Machines Corporation provides information technology (IT) products and services worldwide. The companys Global Technology Services segment provides IT infrastructure and business process services, such as outsourcing, processing, integrated technology, cloud, and technology support. Its Global Business Services segment offers consulting and systems integration services for strategy and transformation, application innovation services, enterprise applications, and smarter analytics; and application management, maintenance, and support services. The companys Software segment provides middleware and operating systems software, including WebSphere software to integrate and manage business processes; and information management software that enables clients to integrate, manage, and analyze data from various sources. It also offers Watson Solutions software to interact in natural language, process big data, and learn from interactions with people and computers; Tivoli software offers integrated service delivery for cloud and datacenter management, enterprise endpoint and mobile device management, asset and facilities management, and storage management; and Workforce Solutions software that enables businesses to connect people and processes. Yahoo! Finance