Monster Beverage Corporation (NASDAQ: MNST)

MNST Earnings

Monster beverage Corporation reported earnings Thursday August 6, 2015 after the market closed and saw its shares go through a wild ride both during the day of trading Thursday as well as in the after-market session. The company which is in the middle of doing a distribution deal with the Coca Cola Company (NYSE: KO) saw its shares initially down during market hours to the tune of 5.93% or -$9.13 closing the stock at $144.87. After the report was released, shares were initially down to a low of $128.88 and subsequently rose to a high of $153.50. A very wild ride to say the least. According to the reports, the Company reported revenue of $693.72M. The estimated revenue was of $753.41M. Earnings per share were $0.79. The reported EPS was below estimates by $-0.12 or -13.19%. Analysts had estimated an EPS of $0.91.

Monster Beverage Conference Call

During and after the conference call ended though ,shares began to rebound and wound up closing at $151.48 or up $6.13, +4.23%. Here is what the CEO Rodney sacks had to say, “We are making good progress in working through transitional issues and the strong dollar index,”. In a press release, Monster said its profitability was “negatively impacted by $12.2 million as a result of distributor termination obligations and $11.5 million transaction expenses associated” with a new partnership with Coca-Cola. A Zacks analyst added this, Despite health-risk claims against energy drinks and a decline in the sales of traditional carbonated beverages, MNST has been able to enjoy great success in the recent past, even with other companies such as Coca-Cola and Pepsi deal with declining sales and popularity in their iconic sodas.

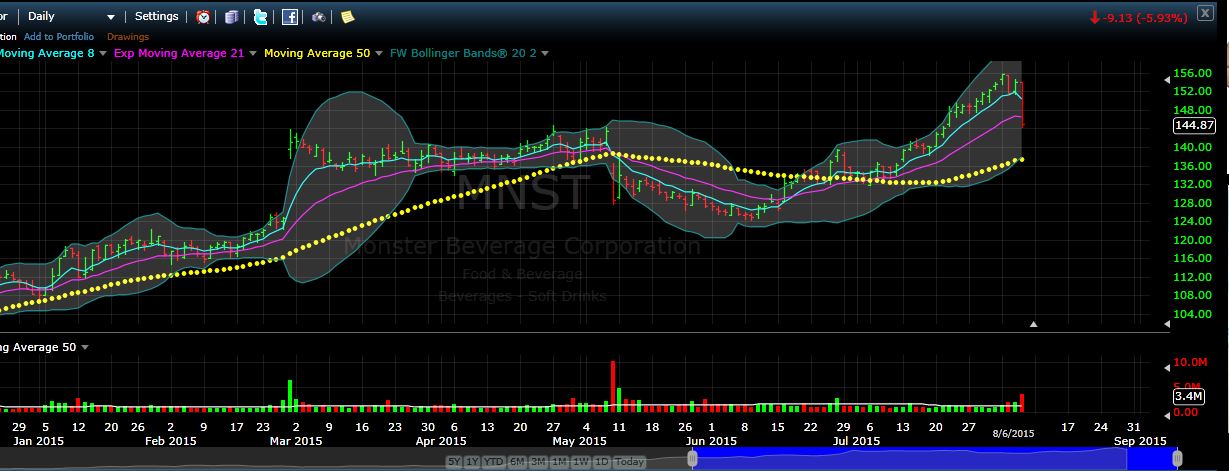

MNST Technicals

Please see the chart showing MNST daily price action. Note the nice uptrend since the beginning of 2015 showing a series of higher highs and higher lows. This demonstrates active mutual and hedge fund purchases and strong support. Clearly Thursday’s trading action both before and after the close show there is a tug of war between the Bulls and the Bears as to the valuation of this company – so the next few days should give a better insight into a continuation or a change of its trend. We shall see.

About Monster Beverage Corp.

Monster Beverage Corporation, through its subsidiaries, develops, markets, sells, and distributes alternative beverage category beverages in the United States and internationally. It operates in two segments, Direct Store Delivery and Warehouse. The Direct Store Delivery segment offers carbonated energy drinks, non-carbonated dairy based coffee plus energy drinks, non-carbonated energy shakes containing proteins, carbonated energy drinks containing nitrous oxide, non-carbonated energy drinks with electrolytes, and ready-to-drink iced teas. The Warehouse segment provides sodas, sparkling water beverages, seltzer waters, energy drinks, fruit juices, juice cocktails, aseptic juices, coconut water juices, ready-todrink lemonades, ready-to-drink lemonade plus tea drinks, powder drink mixes, and probiotic digestive wellness powder drinks. The company offers its products primarily under the Monster Energy, Monster Rehab, Monster Energy Extra Strength Nitrous Technology, Java Monster, Muscle Monster, Punch Monster, Juice Monster, Hansens, Hansens Natural Cane Soda, Junior Juice, Blue Sky, Huberts, and Peace Tea brands. It serves full service beverage distributors, retail grocery and specialty chains, wholesalers, club stores, drug chains, mass merchandisers, convenience chains, health food distributors, food service customers, and the military. The company was formerly known as Hansen Natural Corporation and changed its name to Monster Beverage Corporation in January 2012. Monster Beverage Corporation was founded in 1985 and is headquartered in Corona, California. Yahoo! Finance