JetBlue Airways Corporation (NASDAQ: JBLU)

JetBlue Airways Corporation (JBLU), an airlines company on Thursday reported its traffic results for November 2015. One of the key numbers in the results was that the passenger revenue per available seat mile is expected to go down 2% to 3% year over year for the 2015 fiscal fourth quarter. This figure is a key metric for airline companies. JetBlue had this stay about the results “ “Passenger revenue per available seat mile is negatively impacted in the quarter by the timing of year-end Holidays and a higher completion factor than expected, due to better operational performance and more favorable winter weather than anticipated,”. (The Street) This news led the stock to fall over 5% by mid day trading on Friday.

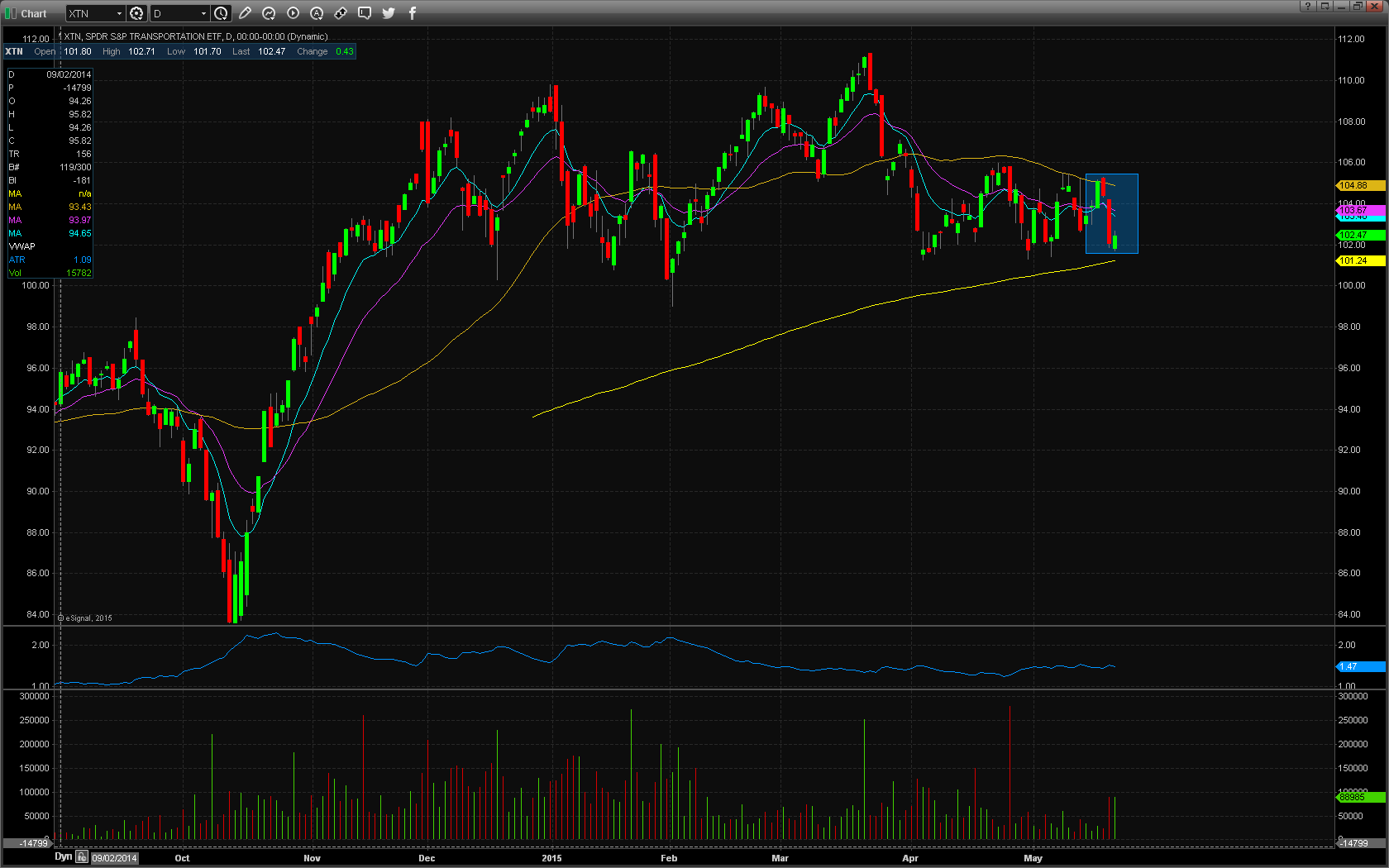

JBLU Technical Analysis

JBLU gapped down in price on Friday to $24.61, down from the prior day’s close of $25.44, which is a 3% decrease on the unfavorable news. Taking a look at the daily chart, we can see the last time JBLU traded below this price level was on October 21st, when it traded at $24.26. Taking a closer look at the daily chart, we can see that JBLU has been in a trading range in between $24 and $27, dating back to the beginning of September. The bottom of that range should be tested with the disappointing current news. JBLU has a float of 312.79 million shares and was trading 1.5 times the normal daily trading volume. JBLU did open right at the pre market lows. For trading purposes, my entry point would have been short $24.50 looking for a move down through $24. My stop loss would have been $24.70, fearing any move above that and the stock would start to fill in the gap down.

Company Profile

JetBlue Airways Corporation (JetBlue), incorporated on August 24, 1998, is a passenger carrier company. JetBlue provides air transportation services across the United States, Caribbean and Latin America. Majority of the Company’s operations are centered in and around the northeast corridor of the United States, which includes the New York and Boston metropolitan areas. As of December 31, 2014, the Company served 87 BlueCities in 27 states, the District of Columbia, the Commonwealth of Puerto Rico, the United States Virgin Islands, and 17 countries in the Caribbean and Latin America. The Company serves the John F. Kennedy International Airport (JFK) in New York. It also serves New Jersey’s Newark Liberty International Airport (Newark), New York’s LaGuardia Airport (LaGuardia), Newburgh, New York’s Stewart International Airport, White Plains, New York’s Westchester County Airport, Boston’s Logan International Airport, Fort Lauderdale-Hollywood International Airport and Orlando International Airport, among others. The Company operates various kinds of Airbus A321, Airbus A320 and EMBRAER 190. As of December 31, 2014, the Company operated a fleet consisting of 13 Airbus A321 aircraft, 130 Airbus A320 aircraft and 60 EMBRAER 190 aircraft. In addition to its core products, the Company also sells vacation packages through JetBlue Getaways, a vacation service for self-directed packaged travel planning. These packages offer competitive fares for air travel on JetBlue along with a selection of JetBlue recommended hotels and resorts, car rentals and attractions. The company also operates customer loyalty program, TrueBlue, designed to reward and recognize loyal customers. Members earn points based upon the amount paid for JetBlue flights and services from certain commercial partners. The Company’s primary and preferred distribution channel to customers is through its website, www.jetblue.com. It additionally has mobile applications for both Apple and Android devices which have features, including real-time flight information updates and mobile check-in for certain routes. Reuters