Monday February 1, 2016

Economic Calendar & Watch List 2/1/2016

Morning Notes

US futures are pointing to a lower open and European markets are trading lower by roughly -.75% as manufacturing economic data out of China contracted the most in the last 3 years which raised more concerns of an economic slowdown in China. Asian stocks closed mixed.

Technicals

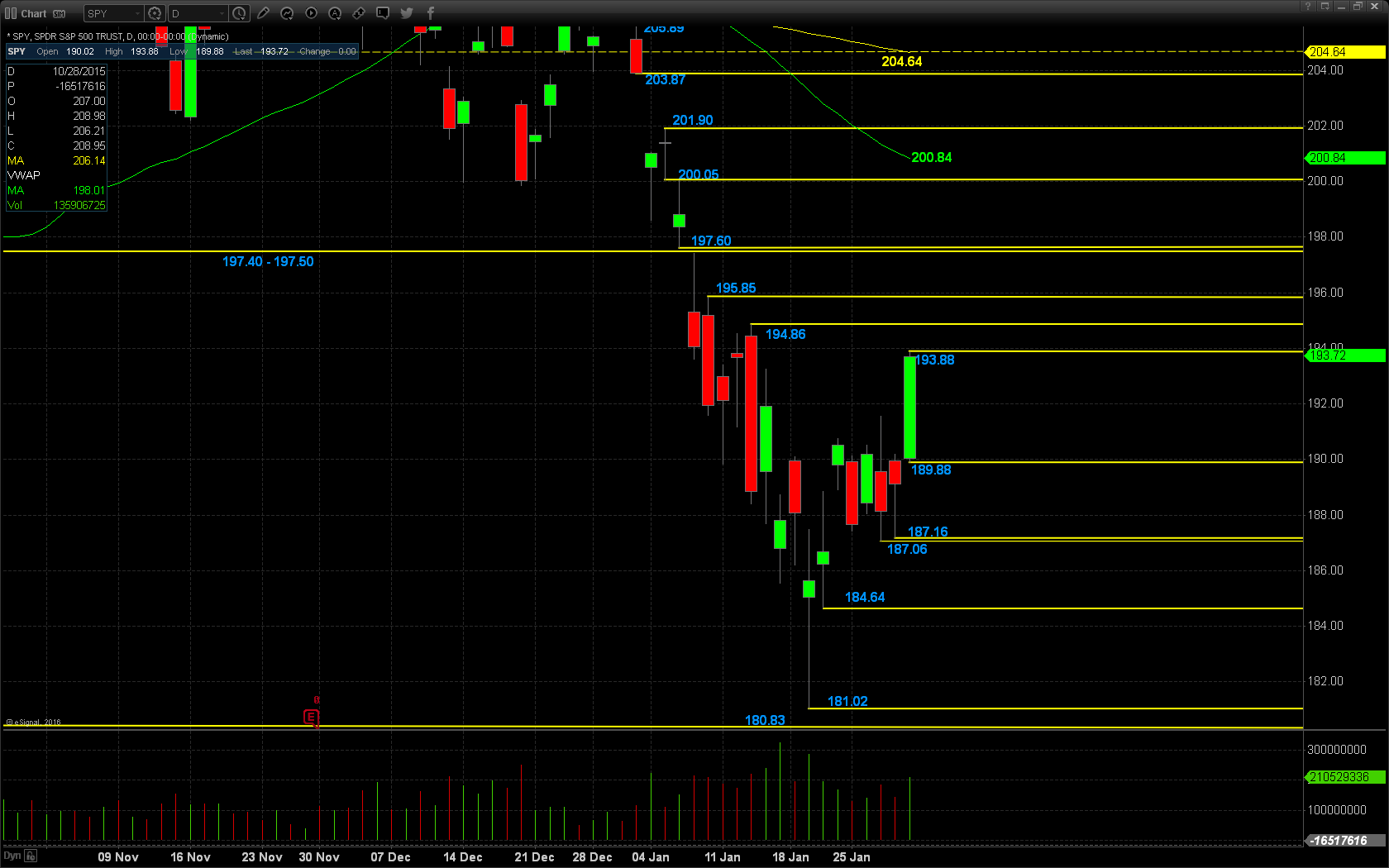

The SPY surged higher in Friday’s session closing out the week on highs. Support will lie at the low of Friday’s range $189.88, followed by the critical pivot zone at $187.16 and $187.06. Resistance will lie at the high of Friday’s range at $193.88, followed by $194.86 and $195.85.

Small Cap Watch List

*Please refer to the momentum scanners displayed live in the chat room for potential plays at the market open.

**Others On Watch**

WYNN

TSLA

Economic Calendar

8:30 Dec personal spending expected +0.1%, Nov +0.3%

8:30 Dec PCE deflator expected unch m/m and +0.6% y/y

9:45 Final-Jan Markit U.S. manufacturing PMI expected unrevised from prelim-Jan +1.5 to 52.7

10:00 Dec construction spending expected +0.6%

10:00 Jan ISM manufacturing index expected +0.5 to 48.5

11:00 USDA weekly grain export inspections

1:00 Fed Vice Chair Stanley Fischer speaks

Notable Earnings Before Open

SYY: Sysco Corp – EPS Est. $.41, Rev Est. $12.14B

CAH: Cardinal Health – EPS Est. $1.25, Rev Est. $29.23B

AET: Aetna – EPS Est. $1.20, Rev Est. $14.93

Notable Earnings After Close

AFL: Aflac – EPS Est. $1.48, Rev Est. $5.21B

APC: Anadarko – EPS Est. $(1.05), Rev Est. $2.09B

TSO: Tesoro – EPS Est. $2.07, Rev Est. $5.83B

February 1st Watch List

ZOES – On watch as this down trender is making another attempt at poking up and over the 20 EMA for a trend reversal. Looking for a move back toward 30 here. Long entry over 28, stop 27.

ITG – A big bull flag testing range highs over the 20 and 50 EMA. Earnings coming up this week may force some short covering. Looking for a move back to 19, then 19.5. Entry is over 17.30, stop 17.

IPHI – Another bullish tech sector setup with a strong hold over all the EMAs. Looking for a long over 28.00, stop 27.50. Room here is to 30, first target 29.50 area.

APOL – Back on watch after setting up again just under the same breakout spot. The entry is over 8.10, stop 7.75. Room here is to 8.41 and then back toward 10. Nice room, just needs to get over the hump.