Tuesday March 1, 2016

Economic Calendar & Watch Lists 3/1/2016

Morning Notes

US futures are pointing higher this morning and European stocks are trading higher by over +1% on speculation that the central banks will move to implement stimulus programs to spark global economic growth. The January Eurozone unemployment report fell to the lowest rate in 4 years lifting European markets. Asian stocks closed higher.

Technicals

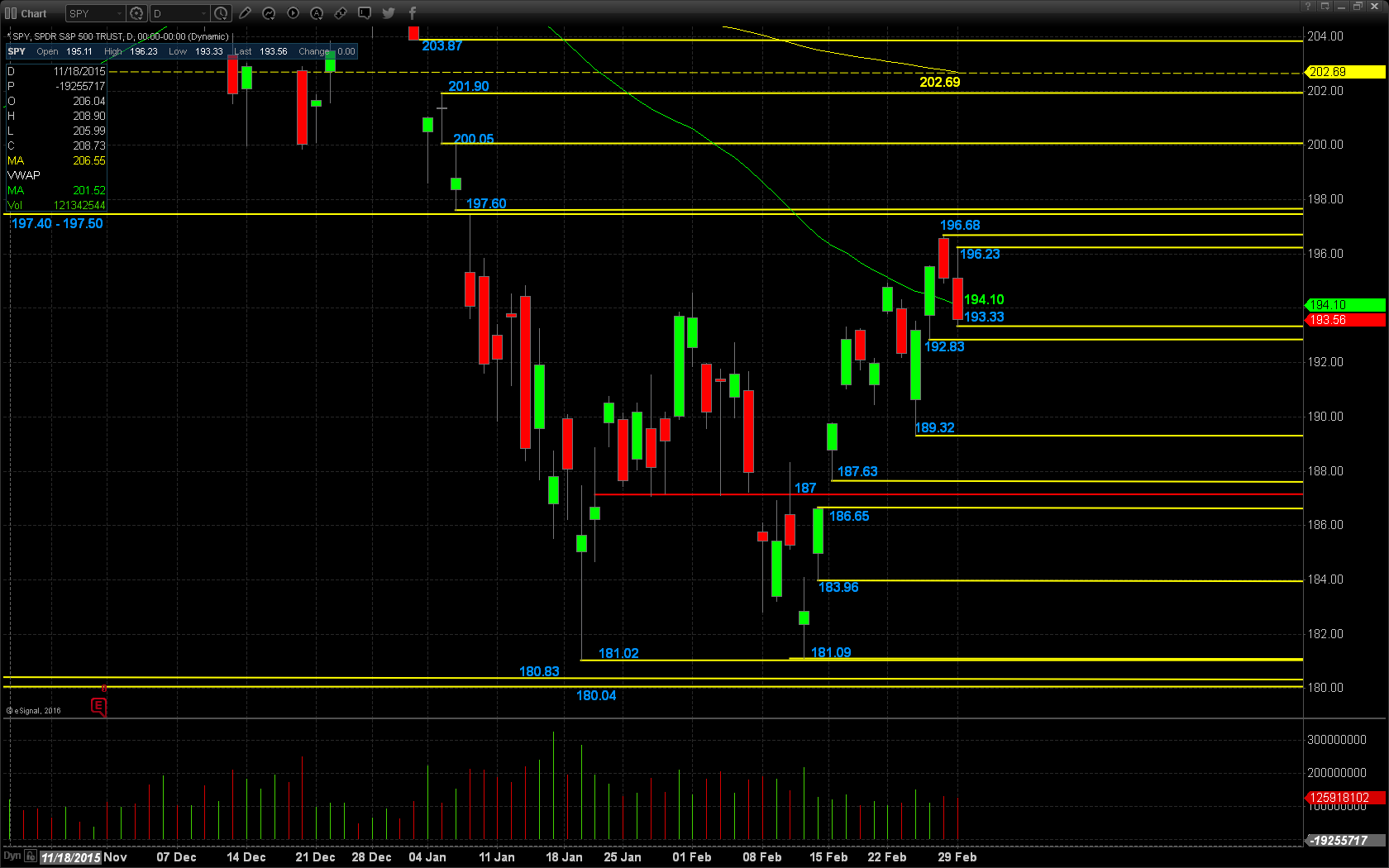

The SPY traded lower in yesterday’s session closing back below the 50 day SMA. Due to the gap higher this morning, support will lie at the 50 day moving average at $194.10, followed by the low of yesterday’s range at $193.33. Resistance will lie at the high of yesterday’s range at $196.23, followed by $196.6, and heavy resistance between $197.40 – $197.60.

Small Cap Watch List

*Please refer to the momentum scanners displayed live in the chat room for potential plays at the market open.

**Others On Watch**

DLTR

WYNN

LVS

WDAY

Economic Calendar

9:45 Revised Feb Markit manufacturing PMI expected +0.2 to 51.2

10:00 Feb ISM manufacturing index expected +0.3 to 48.5, Jan +0.2 to 48.2

10:00 Jan construction spending expected +0.3%, Dec +0.1% m/m

Notable Earnings Before Open

AZO: Auto Zone – EPS Est. $7.28, Rev Est. $2.26B

KATE: Kate Spade – EPS Est. $.32, Rev Est. $441.64M

DLTR: Dollar tree – EPS Est. $1.07, Rev Est. $5.41B

MDT: Medtronic – EPS Est. $1.06, Rev Est. $6.99B

Notable Earnings After Close

DKS: Dick’s Sporting Goods – EPS Est. $1.16, Rev Est. $2.29B

March 1st Watch List

MXWL – A previous multi alert winner from 2015, this big mover is back on watch. What I like here is the gap fill and move back up and through the EMAs. MXWL tends to have one of the cleaner, easier to manage daily charts once it is trending. Long on this is over 5.80, stop 5.50. Target here is to 6.30-6.40 short term.

TTMI – A great big bull flag following earnings with a pretty clear top 6.60-6.70. The room here is to 7.20 short term. Long entry will be with a starter over 6.60, add over 6.70. Stop will be 6.50.

UIHC – On watch following earnings beat and a dividend announcement. A strong stock with clear resistance at 19.80 going to 2014. Long is over 19.80, add at 20. Stop is 19.45. First target will be 21.30.

HCN – Another big runner with a 20% move straight up after earnings and off the lows. This is finally showing some slowing at a top and will be on short watch. Room is back down to 60-61. I like this for a short off 65 resistance and an add on new lows, or under the lows now 63.38, stop over 64.