Monday March 7, 2016

Economic Calendar & Watch Lists 3/7/2016

Morning Notes

US futures are lower this morning and European stocks are trading lower by over -1% after China slashed its growth expectation by .05%, Asian stocks closed mostly mixed.

Technicals

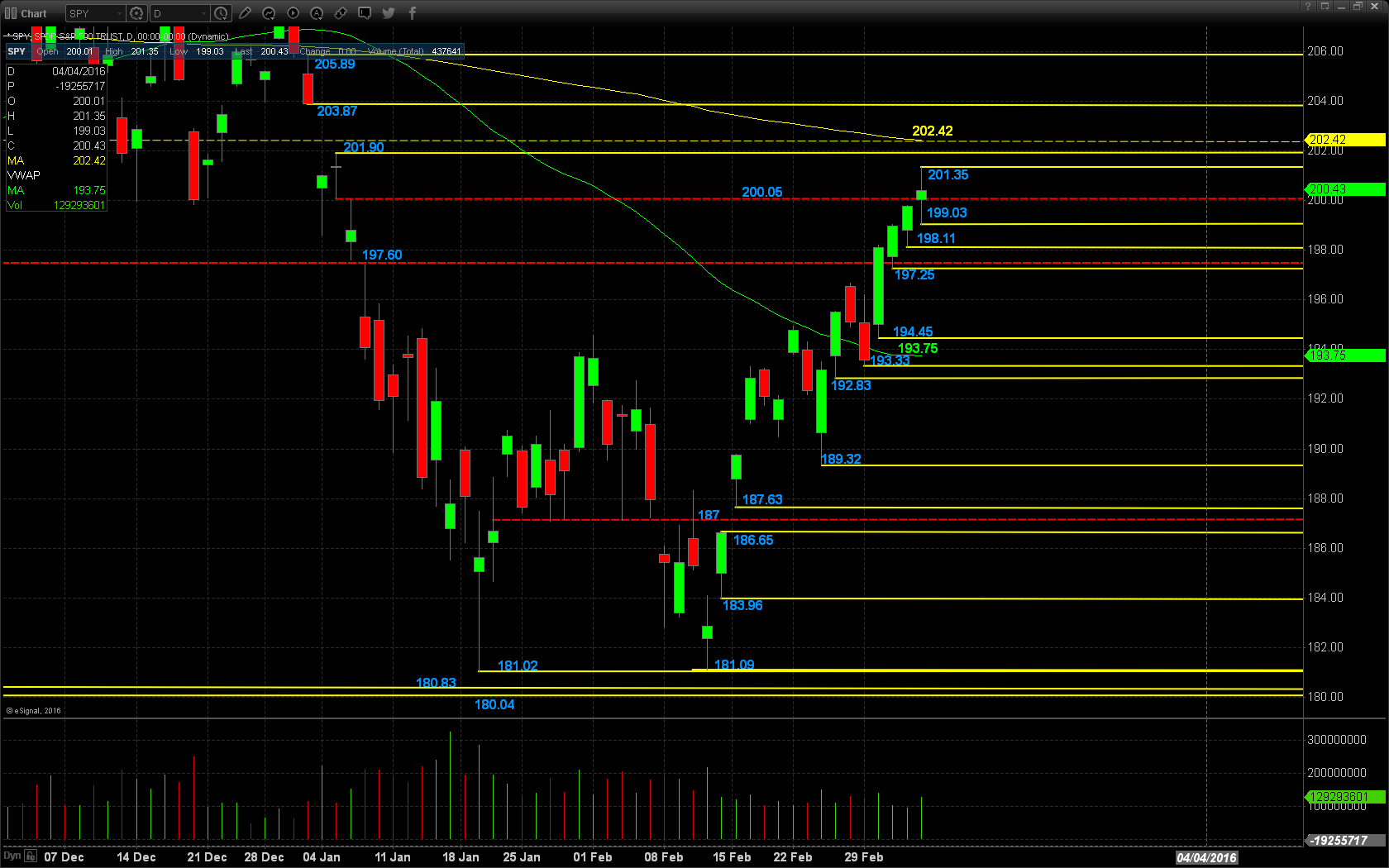

The SPY pushed higher in Friday’s session closing back above the $200.05 pivot level. Support will lie at the critical pivot level of $200.05, followed by the low of Friday’s range at $199.03, $198.11, and the next zone of critical support from $197.60 – $197.40. Resistance will lie at the high of Friday’s range at $201.35, $201.90, and the 200 day SMA at $202.42.

Small Cap Watch List

*Please refer to the momentum scanners displayed live in the chat room for potential plays at the market open.

**Others On Watch**

VRX

MU

Economic Calendar

11:00 USDA weekly grain export inspections

12:00 Fed Governor Lael Brainard speaks

1:00 Fed Vice Chair Stanley Fischer delivers speech

3:00 Jan consumer credit expected +$16.5B

Notable Earnings Before Open

NONE

Notable Earnings After Close

UNFI: United Natural Foods – EPS Est. $.48, Rev Est. $2.05B

SHAK: Shake Shack – EPS Est. $.07, Rev Est. $50.44M

March 7th Watch List

MITK – A great bull flag setup on the daily and a previous runner. Long entry is over 5.75 area, stoop 5.50. Room here is to 6.50 and then 7.00.

YRCW – Target on this up trender is 9.80 and then 10.90. The 50EMA is at 10. Looking for a long over 9.40, stop 9.00.

URBN – On watch for an earnings play after the close Monday. Will be eyeballing an iron condor to capitalize on the volatility crush. Looking at the Mar16 23/25/30/32 iron condor for a net credit around .40-.50.

SHAK – Another earnings play here where our risk is defined, and our probability of success is over 80%, thanks to volatility crush. Looking at the Mar16 34/36/48/50 iron condor, net credit around .70c per spread.

IP – Using our reversal strategy, this looks to be the next big runner to come in. We have some defined targets on this at 37.00 and then 35.70 area. Short entry will be under 38.60 and an add under 38.13-38.00.