Tuesday March 22, 2016

Economic Calendar & Watch Lists 3/22/2016

Morning Notes

US Futures are slightly lower this morning and European stocks are trading lower by -.6% after terrorist attacks in Brussels’ Belgium airport and subway station killing at least 25. Transportation stocks are leading the overall market lower in pre market trading. Asian markets closed mixed.

Technicals

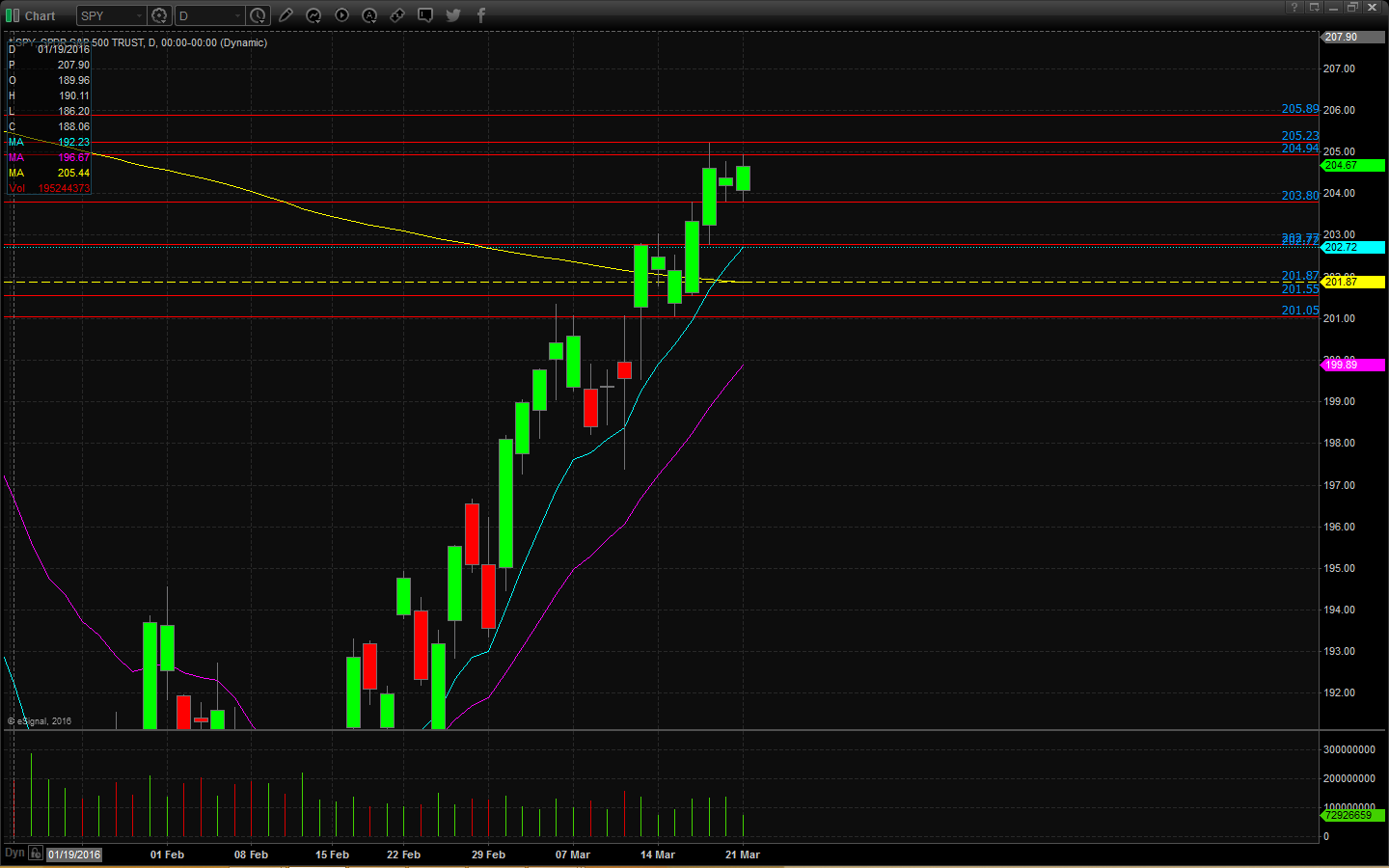

The SPY put in a double bottom at a pivot low in yesterday’s session at $203.80. Support will lie at the low of this pivot at $203.80, followed by $202.77 and the 9 EMA at $202.72. Resistance will lie at the high of yesterday’s range at $204.94, followed by $205.23 and $205.89.

Small Cap Watch List

*Please refer to the momentum scanners displayed live in the chat room for potential plays at the market open.

**Others On Watch**

$SRPT

$CCL

Economic Calendar

9:00 Jan FHFA house price index expected +0.5%

9:45 Markit preliminary-Mar U.S. manufacturing PMI expected +0.6 to 51.9

10:00 Mar Richmond Fed manufacturing index expected +4 to 0

12:30 Chicago Fed President Charles Evans speaks

Notable Earnings Before Open

NONE

Notable Earnings After Close

NKE: Nike – EPS Est. $.48, Rev Est. $8.2B

RHT: Red Hat – EPS Est. $.48, Rev Est. $537.20M

SUNE: SunEdison – EPS Est. $.84, Rev Est. $747.34M

March 22nd Watch List

$CSII – On watch for the third time in the past month. Maybe this will be the time it goes. Long entry over 10.30-10.40, add spot over 10.70. Stop is at 10. Room here is up to 11.85 if we get into the gap.

$VIPS – After seeing the 20 and 50 EMAs pinch, we can tell it was time to step up or break down. Well, VIPS chose up and is in the beginning of a bull trend. Long over 12.92-13.00, stop 12.50. Room to 13.50 and then 14.60.

$LRCX – On reversal watch as this big mover has put up over 25% in a month. I see room here back down to 76, as this has bumped and failed 80 now. Looking for an entry under the lows, 78.95. If this moves higher, even better, I will watch to start a short as close to 80 as possible. RSI is in overbought land now.

$UPS – A sympathy mover to FDX, this overbought high flier is testing big resistance with an extended daily chart. Looking for a short back down to 103-102.50. Entry will be near 106 or under 105, add spot under 104.