Wednesday June 1, 2016

Economic Calendar & Watch Lists 6/1/2016

Morning Notes

US Futures are modestly lower this morning while European stocks are trading lower by nearly -1%. Japan experienced the sharpest contraction in three years in PMI, while China’s has flatlined which led to Asian stocks closing lower. Crude oil slid over -1% which has put pressure on energy producer stocks.

Technicals

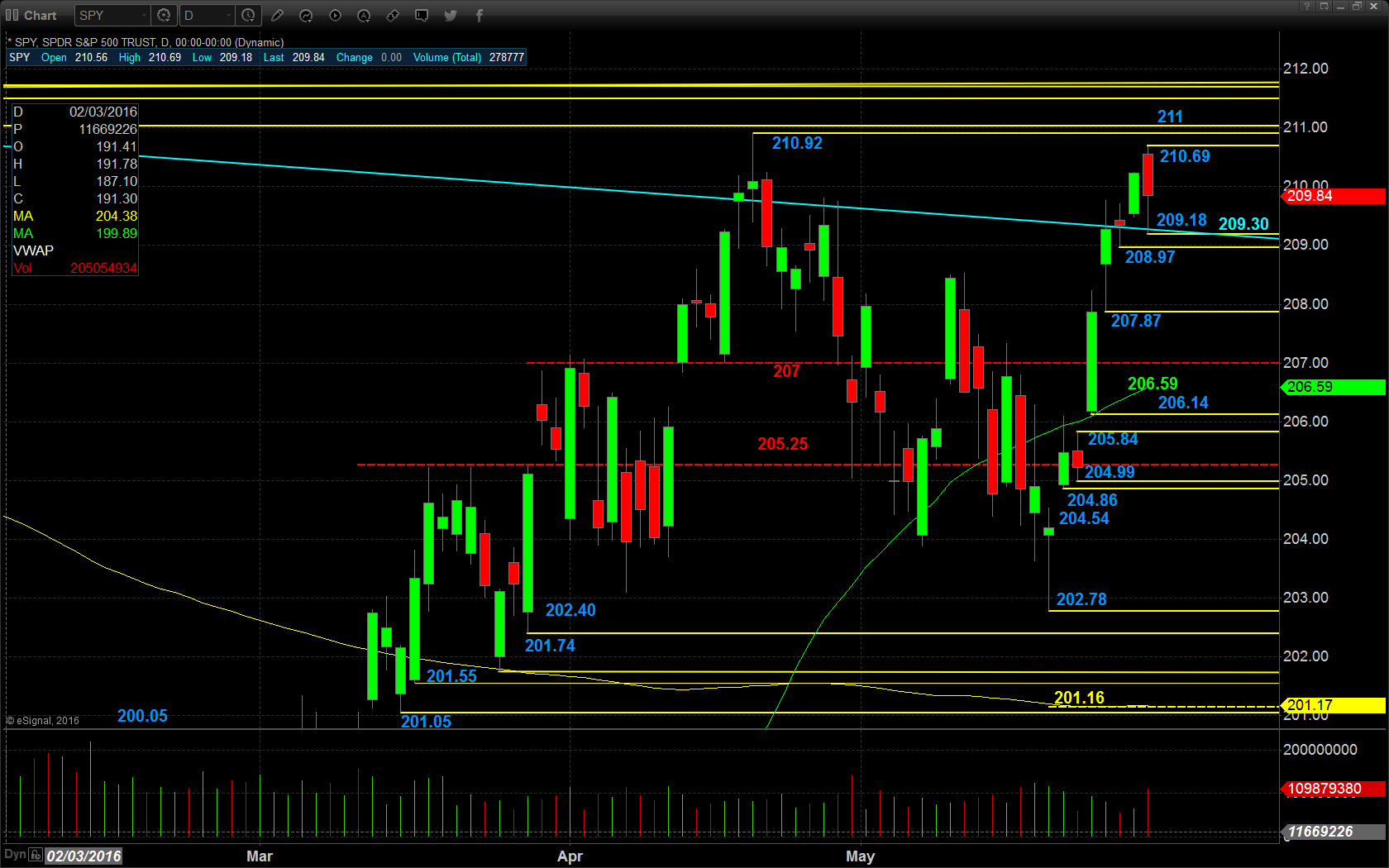

The SPY initially moved higher in yesterday’s session after retesting the macro resistance channel and later drifted back off highs to close lower. This morning, the SPY is moving lower and pushing back below the macro speed line. Support will lie at the low of yesterday’s range, followed by $208.97, $207.87, and the most recent critical pivot at $207. Resistance will lie at the macro resistance line at $209.30 – $209.50, followed by the high of yesterday’s range at $210.69 and $210.92.

Small Cap Watch List

*Please refer to the momentum scanners displayed live in the chat room for potential plays at the market open.

**Others On Watch**

$NKE

$UA

$KORS

Economic Calendar

9:45 Revised-May Markit U.S. manufacturing PMI expected unchanged at 50.5

10:00 May ISM manufacturing index expected -0.5 to 50.3

10:00 Apr construction spending expected +0.6%

2:00 Fed Beige Book

Notable Earnings Before Open

KORS: Michael Kors – EPS Est. $.96, Rev. Est $1.15B

VRA: Vera Bradley – EPS Est. $.05, Rev. Est $106.75M

Notable Earnings After Close

ALR: Alere – EPS Est. $.41, Rev. Est $N/A

BOX: EPS Est. $(.24), Rev. Est $88.65M

June 1st Swing Watch List

$PTCT – Gearing up to make a move, If IBB can keep the momentum going. Long entry is over 8.40, stop 8.00. Room is to 9.00 and then 10. This is a volatilize mover but nice setup for a breakout.

$SXC – Not normally a fan of energy names, but this setup is nice. Long entry is over 6.16-6.20, stop 5.95. Target is 6.90.

$CVGI – A strong bull flag with a lot of upside room. Long entry over 3.80, stop 3.50. Target is 4.25, then 4.50.

$TSLA – I like this for an option debit strategy. Low IV with a nice bull flag setup. Will be looking at a Jul16 225/230 debit spread.