Thursday June 2, 2016

Economic Calendar & Watch Lists 6/2/2016

Morning Notes

US Futures are relatively flat and European stocks trade just slightly higher as the markets await the ECB interest rate decision. The expectation is for no change to rates or economic stimulus. Asian stocks closed mixed as the Nikkei dropped by -2.2%, the most in a month.

Technicals

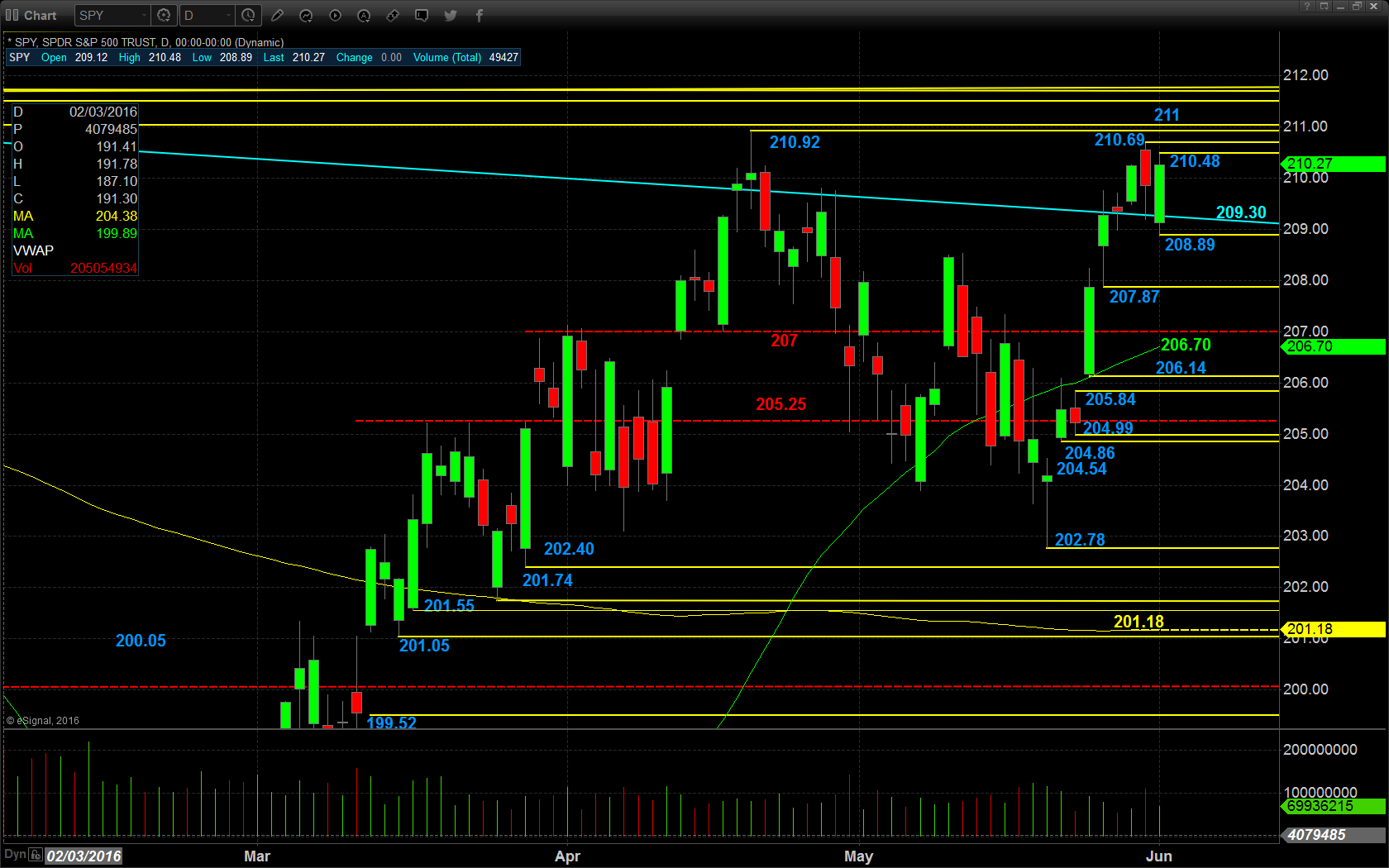

The SPY held above the macro resistance channel and moved higher in yesterday’s session, closing just off the highs. Support will lie at the low of yesterday’s range at $208.89, followed by $207.87, and then the most recent critical pivot at $207. Resistance will lie at the high of yesterday’s range at $210.48, followed by $210.69, $210.92, and 211.

Small Cap Watch List

*Please refer to the momentum scanners displayed live in the chat room for potential plays at the market open.

**Others On Watch**

$COST

Economic Calendar

8:15 May ADP employment change expected +174K

8:30 Weekly initial unemployment claims expected +2,000 to 270K

9:45 May New York ISM, Apr +6.6 to 57.0

11:00 EIA Weekly Petroleum Status Report

1:00 Dallas Fed President Robert Kaplan speaks

Notable Earnings Before Open

JOY: Joy Global – EPS Est. $.00, Rev Est. $607.72M

Notable Earnings After Close

AVGO: Broadcom – EPS Est. $2.37, Rev Est. $3.55B

June 2nd Swing Watch List

$LC – On watch for a recovery attempt back toward the gap. Long entry is over 5.05-5.10, stop 5.75. Target is 5.63, then 6.30.

$BIOS – This king of fakeouts is on watch again at the same levels. Looking for long entry over 2.87, stop 2.70. Target is 3.10 and then 3.40.

$NEOS – A low volume mover with big range. Love the room here. Long is over 11.15, stop 10.75. Target is 12.15 and then 14.

$SEDG – Short entry on this reversal setup is under 20.70, add 20.50. Room to 18.40 or so.