Thursday January 19, 2017

Economic Calendar & Watch List

Morning Notes

US Futures are relatively flat this morning while European stocks trade just slightly lower as markets await the results of today’s ECB meeting. Traders will be listening closely to ECB president Draghi for any clues into a taper of their current QE program. The price of crude is edging higher by +1.2% giving energy producing stocks a lift. Asian stocks closed mostly mixed.

Technicals

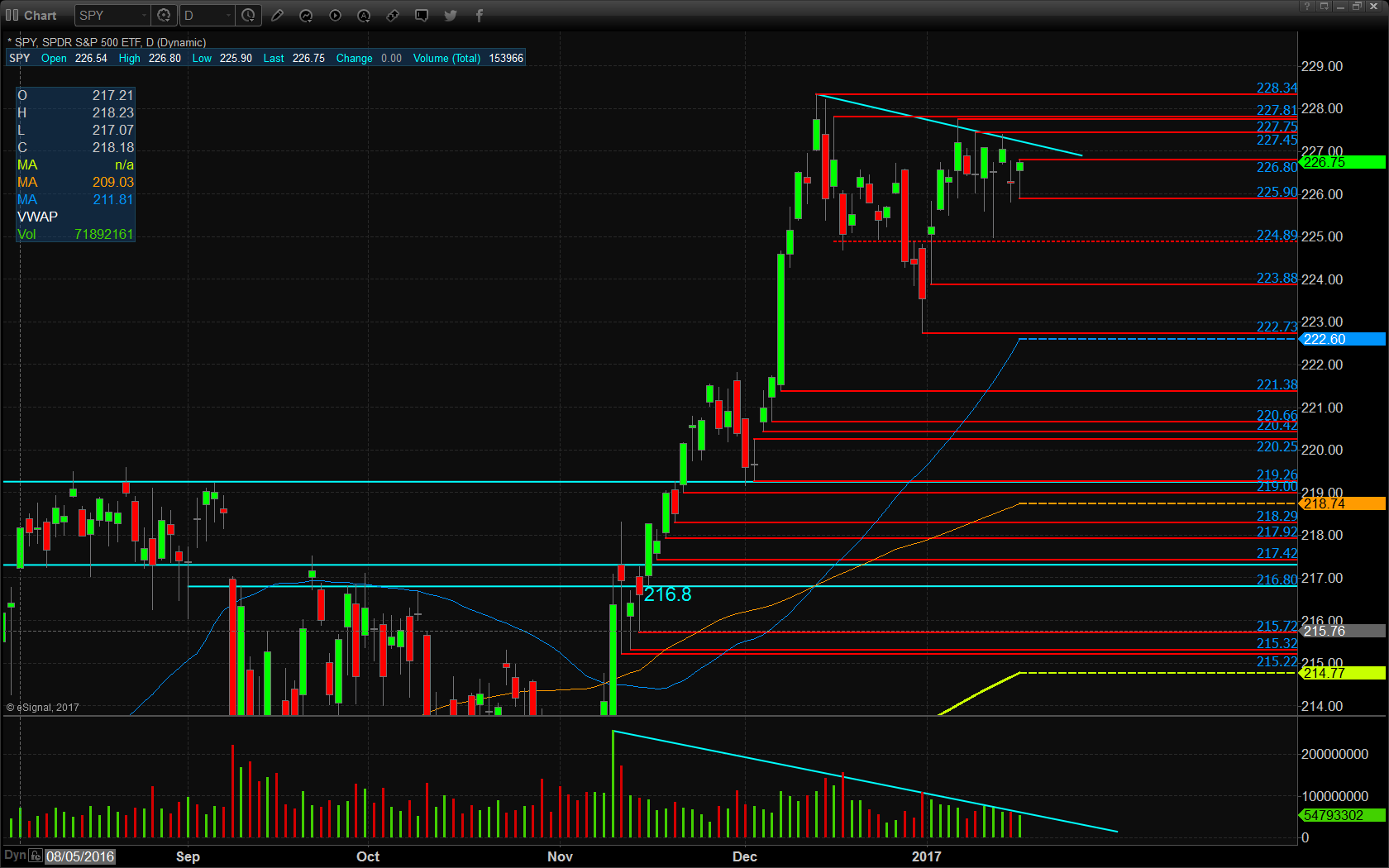

The SPY consolidated further throughout yesterday’s sessions on continued light volume trading as stocks stall ahead of earnings. Support will lie at the low of yesterday’s range at $225.90 where a new pivot is beginning to form, followed by the recent support pivot at $224.89, then $223.88 and $222.73. Resistance will lie at the high of yesterday’s range at $226.80, followed by the short term descending resistance at $227.25, then $227.45, $227.75, $227.81, and all time highs at $228.34.

Small Cap Watch List

*Please refer to the momentum scanners displayed live in the chat room for potential plays at the market open.

**Others On Watch**

$MNK

$CSX

Economic Calendar

8:30 Weekly initial unemployment claims expected +5,000 to 252K

8:30 December housing starts expected +8.9% to 1.187M

8:30 January Philadelphia Fed business outlook survey expected -4.9 to 15.1

11:00 EIA Weekly Petroleum Status Report

Notable Earnings Before Open

BB&T Corp. (BBT) – EPS Est. $0.73

KeyCorp (KEY) – EPS Est. $0.29

Union Pacific (UNP) – EPS Est. $1.33

Notable Earnings After Close

American Express (AXP) – EPS Est. $0.98

Skyworks Solutions (SWKS) – EPS Est. $1.58