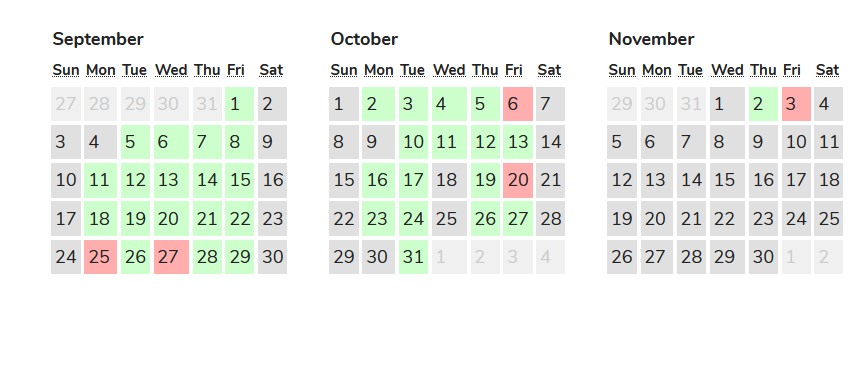

I finished October with over $50k in gross profit day trading, which was pretty impressive. It made it my second-best month of the year, just behind August. What was nice was the fact that I was able to generate that profit without any home run days. I had a couple decent days, but nothing super exciting. I did, however have a few days where I gave back a bit more profit than I’d have liked. There were two days when I crossed over $10k and gave most of it back.

Slow Start to November

As we begin the new month, November began with a no-trade-day. I just didn’t see anything worth pulling the trigger on. So Wednesday morning was a no-trade day, but on Thursday I locked up just under $5k in profits. On Friday, I gave back $600. So the month seems to be off to a slow start.

Something that I think is noteworthy is the fact that the overall market has been in a declining trend since the peak in August. From October 2022 through August, we were making steady gains. But in August, we peaked and pulled back through the month of September and October. The S&P 500 even broke below the 200 exponential moving average. Currently, we are back above the 200 ema s the Federal Reserve indicated maybe they are done raising interest rates. But they also said, maybe they aren’t done. The market only heard the first part of that status as prices moved up going into the weekend.

Building a Profit Cushion

Although we are only three days into the month, I’ve already seen several traders comment on taking big losses that has left them in the red. I’m trying to avoid going into a drawdown on the month. That means my first order of business is to build a profit cushion on the month of $10k. Once I’ve gained a little cushion, I can begin to take a bit more risk and push a little harder on days when it seems hot. One of the challenges is on slower months when I’m never able to build a cushion. On those months, I stayed in “conservative” trading mode pretty much the whole month through. However, I’d rather do that than get aggressive when the market doesn’t call for it and dig myself a big hole.

It’s too soon to tell whether or not I’ll be able to get aggressive this month, but I’m grateful at the very least for a nice green day on Thursday that has given me at least a little buffer off of being breakeven on the month.

Santa Rally

I think most traders are still optimistic that we’ll see the annual Santa Rally going into the end of the year. We made it through October without a stock market crash (always a good sign) so now we are all waiting for the market to pick up steam. From a technical perspective, the market needs to break and hold above the descending resistance level that has formed in the past two months. Depending on how those resistance lines are drawn, you could argue we’ve already broken the resistance, but we need to hold above it. After 5 strong green sessions in a row, the market feels due for a pullback.