Wednesday February 17, 2016

Economic Calendar & Watch Lists 2/17/2016

Morning Notes

US futures are higher this morning by over +.5% and European markets are trading higher by nearly +2% as the price of crude moves higher boosting energy producers. Asian stocks closed mixed across the board.

Technicals

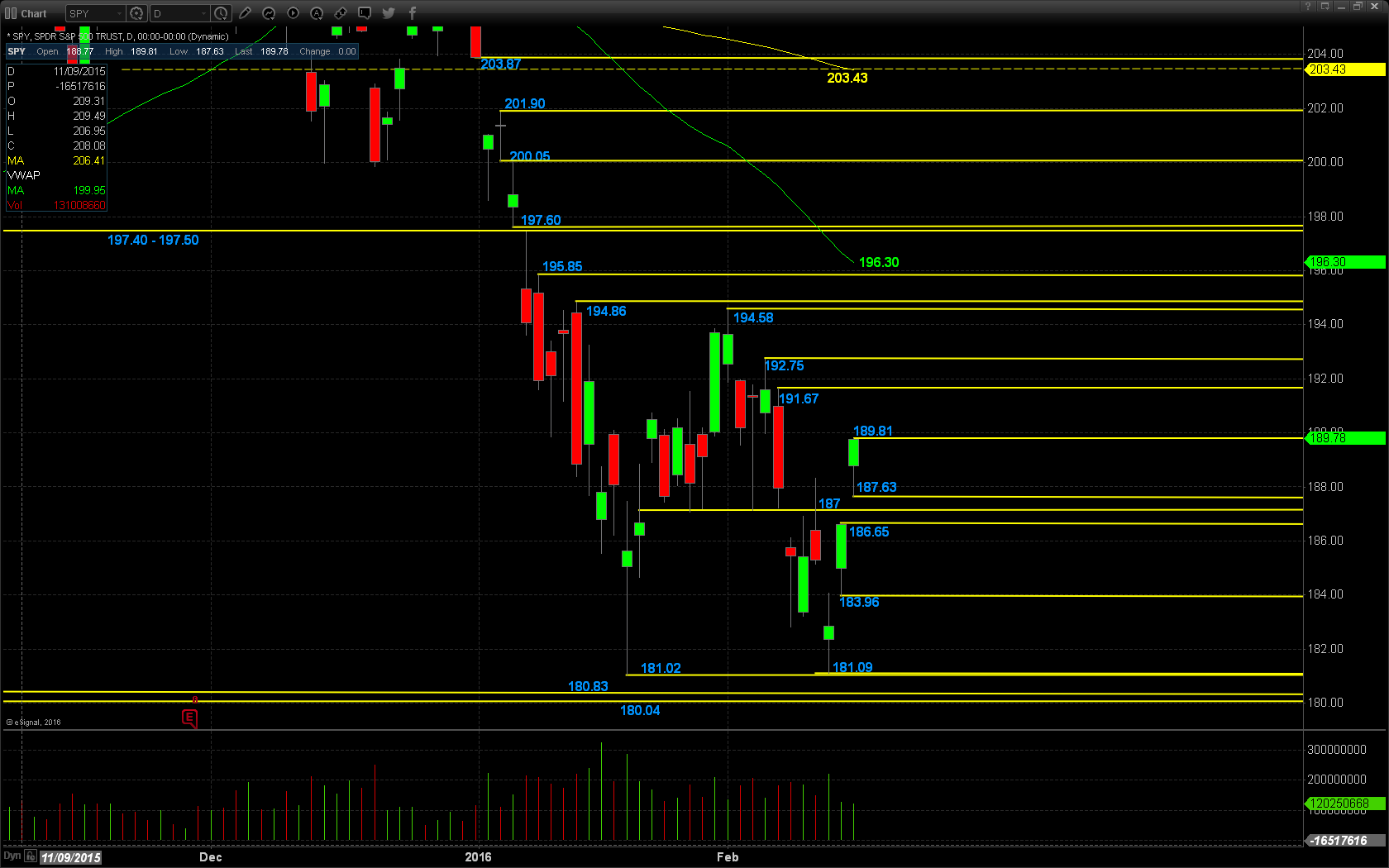

The SPY moved higher again in yesterday’s session closing out the day on the highs. The SPY is gapping higher this morning and looking to continue the rally. Support will lie at the high of yesterday’s range at $189.81, followed by the low of yesterday’s range at $187.63, and the recent pivot of $187. Resistance will lie at $191.67, followed by $192.75 and $194.58.

Small Cap Watch List

*Please refer to the momentum scanners displayed live in the chat room for potential plays at the market open.

**Others On Watch**

FOSL

RAX

AAPL

Economic Calendar

8:30 Jan housing starts expected +1.8% to 1.170 million

8:30 Jan PPI final demand expected -0.2% m/m and -0.6% y/y

9:15 Jan industrial production expected +0.3%, Dec -0.4%

2:00 Minutes of the Jan 26-27 FOMC meeting

Notable Earnings Before Open

GRMN: Garmin – EPS Est. $.47, Rev Est. $760M

Notable Earnings After Close

MAR: Marriott – EPS Est. $.76, Rev Est. $3.73B

WMB: Williams Co – EPS Est. $.18, Rev Est. $1.95B

NTAP: NetApp – EPS Est. $.68, Rev Est. $1.45B

MRO: Marathon Oil – EPS Est. $(.50) Rev Est. $1.18B

NVDA: NVIDIA – EPS Est. $.32, Rev Est. $1.31B

February 17th Watch List

KRA – Watching for a long move over the range highs, big ressitance at 15.10. Long entry is over 14.72 and then add over 15.10. Stop is 14.50. Target is 16.20 and then 17.

VSI – Swing watch for the breakout over consolidation after a solid rejection of the lows. Strong close over the 20 and 50 EMAs with plenty of upside in a short time. Long entry is over 31, stop 30.50. Room here is to 32, then 33.30s.

TMHC – A sweet looking breakout mover creeping into a squeeze zone on the TAS market maps. Looking for a move back to 15, 13.75 first stop. Long entry over 13. Stop 12.50 initially.

RRC – A lovely setup for my choice of hedge against my open USO buy write. RRC has just completed a 60% move in two weeks and is now in the middle of retracement. Should oil fall after the news this week, I want a hedge on something with room to die with it. Short starter under 25.50, then add at 24.89. Stop will be 26. Target will be 22.5 and then 21.50, initially. Small size as this can be a wide mover, but very liquid none the less.

IBB* – Options play. Keep this on watch all week. Depending on how the SPY handles resistance coming up at 194, I like this for a bear put or bear call spread back toward 240 support. I will be sure to track this on watch for the week (hence the *).