McDonalds(NYSE: MCD) “ McChange”

On May 4, 2015 McDonalds announced sweeping changes in a few areas of their global operations by CEO Steve Easterbrook in a video announcement to investors and shareholders. Mr. Easterbrook took over at McDonalds on March 1st and has stated he will “not shy away from an urgent need to reset the McDonald’s business plan”. Initial reaction to his comments seemed ho-hum and mixed at best as the shares closed down $1.67 to $96.13 by Monday’s close before rising to a high of $98.63 intra-day.

Some Changes

One major change will be in the number of franchisees that own actual McDonald’s locations. The change will go from increasing franchisees by 1500 by 2016 to a whopping 3500 by year 2018. Below is a bar chart example showing the difference that McDonald’s plans to make. Basically they would go from adding 1500 new franchisees by 2016 to 3500 franchisees by 2018 or more than double.

Another major change comes in streamlining of its menu. Just last week McDonald’s cut a few long-standing menu products: namely, deluxe quarter pounder burgers and 6 chicken sandwiches as it clearly streamlines the menu to make less equal more in the eyes of customers. Since many customers have flocked to the likes of Chipotle Mexican Grill (NYSE: CMG) for a healthier choice of food, McDonald’s may be feeling the need to follow suit albeit in the McDonald’s way of doing things- fast and drive thru. They also talked of making individual franchisees take a more active role in new menu products.

Another change they planned but did not go into specific details is a modernization of the way the stores look. Details of this have not been put out to the public but we can expect to obviously notice the change in how they look and how they make us feel while inside the venues.

Standard and Poors Downgrade

Not helping matters Standard and Poors lowered McDonald bond ratings citing, “The return to shareholders of about $8.5 billion this year will necessitate higher leverage than we forecast and represents a more aggressive shift toward shareholders returns than we previously assumed … We are lowering the corporate credit rating to ‘A-’ from ‘A’ since the company’s credit metrics will now be below our previous expectations for the rating”.

Moody’s did not downgrade but stated they would put on for a review to be lowered as well.

Chart and Price Performance

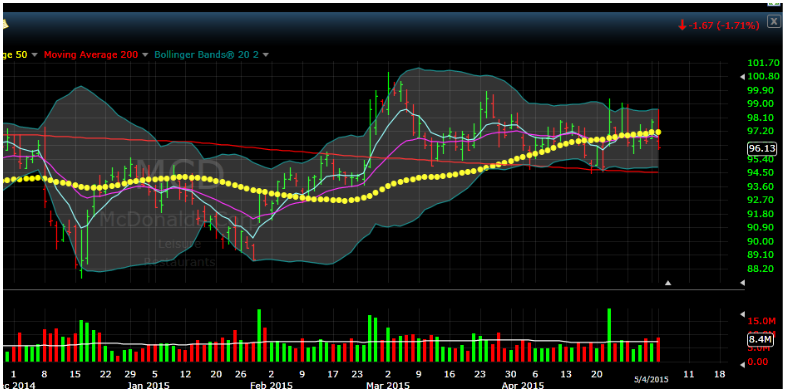

Below is a daily bar-chart of price action since December 2014 to present. Note the red overlapping price bar from today Monday May 4th 2015. This shows the initial enthusiasm in todays announcement and the subsequent sell-off by the close of trading.

Time will tell if McDonalds can reinvent themselves in a more health conscious eating America, where competition is fierce and getting more difficult as competitors ramp up their menus as well, acknowledging that McDonald’s -once great -can possibly retake America as their go-to low-cost Restaurant of choice.