Trading through the Volatile Markets

Traders and Investors have been struggling in the last week as news out of Greece weighs heavily on the US equity Markets. Last Monday the market experienced a triple figure drop and it happened again today. In the late morning markets have been bouncing off the lows and this has provided traders with exceptional opportunities to pick up trades for reversal setups. In the Day Trade Courses offered at Warrior Trading all of our students have access to the proprietary scanners that find reversal setups in real-time. As Day Traders we rely on the stock scanning software to sift through thousands of stocks at once and find out go to setups. Two particularity good setups today were on YOKU and SINA, but there were also several other very strong reversal patterns. Charts are highlighted below.

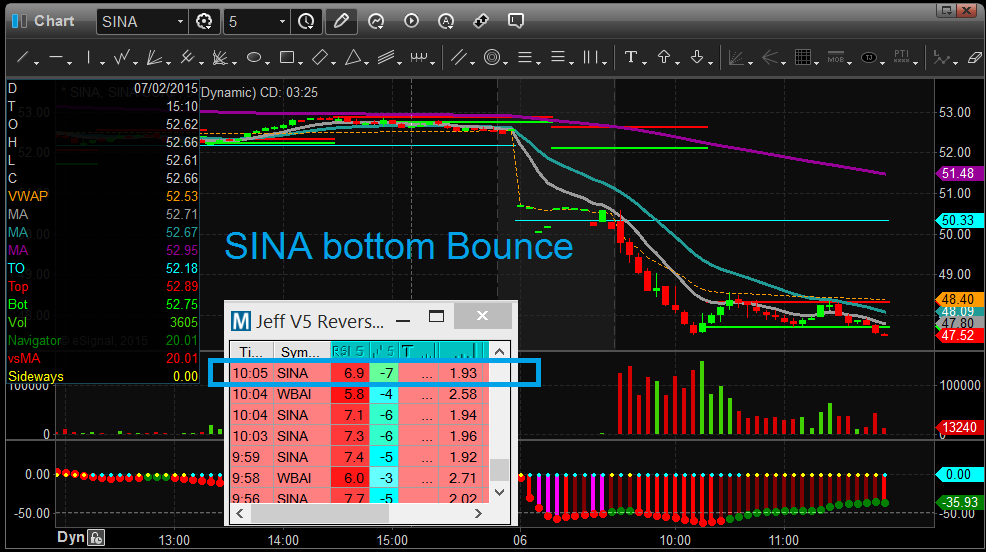

Reversal Potential of $SINA (Sina Corp)

Sina Corp appeared on our bottom bounce reversal scanner early in the trading day. At the time of the alert shares had already sold off for 5 consecutive 5min candles. The longer shares continue to sell off the greater the opportunity for a strong reversal. At the bottom of the sell off we had 8 consecutive candles each making a new low. As day traders we picture a rubber band stretched out. The further the rubber band stretches the more it will snap back when the reversal begins. This is like a tide changing. On $SINA the tide changed quickly as shares made a quick rally off the low. This presented an excellent buying opportunity for short term traders.

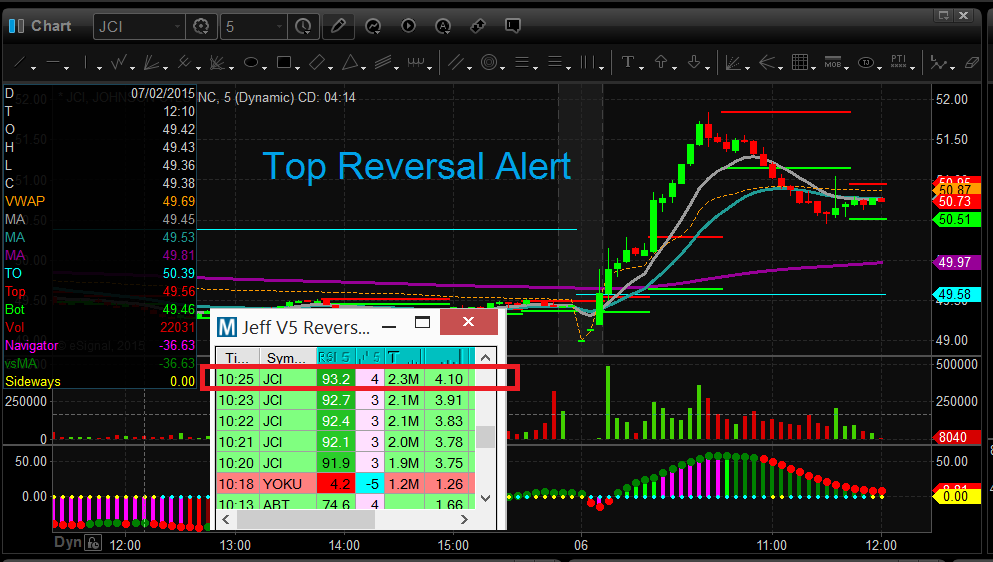

The Reversal Opportunities in $YOKU

Just following the SINA reversal shares of YOKU began to put in a similar strong sell off which is indicative of a pending reversal. YOKU achieved an impressive 8 consecutive red candles on it’s sell off which bottomed out at 20.35. From those lows the stock make a nice recovery back up to $21 before finding resistance at the VWAP (Volume Weighted Moving Average). Technical traders often note areas of mental resistance around these critical levels. Both SINA and YOKU presented excellent low risk opportunities that were helped in part by the greater market sell off. This is an example of when larger market forces can help create intraday buying opportunities.