Monday April 11, 2016

Economic Calendar & Watch Lists 4/11/2016

Morning Notes

US futures are are modestly higher this morning led by AA trading higher in the pre market as they kick off earnings season this evening. European stocks are trading higher by +1% led by a move higher in European banks. Asian stocks closed mixed across the board.

Technicals

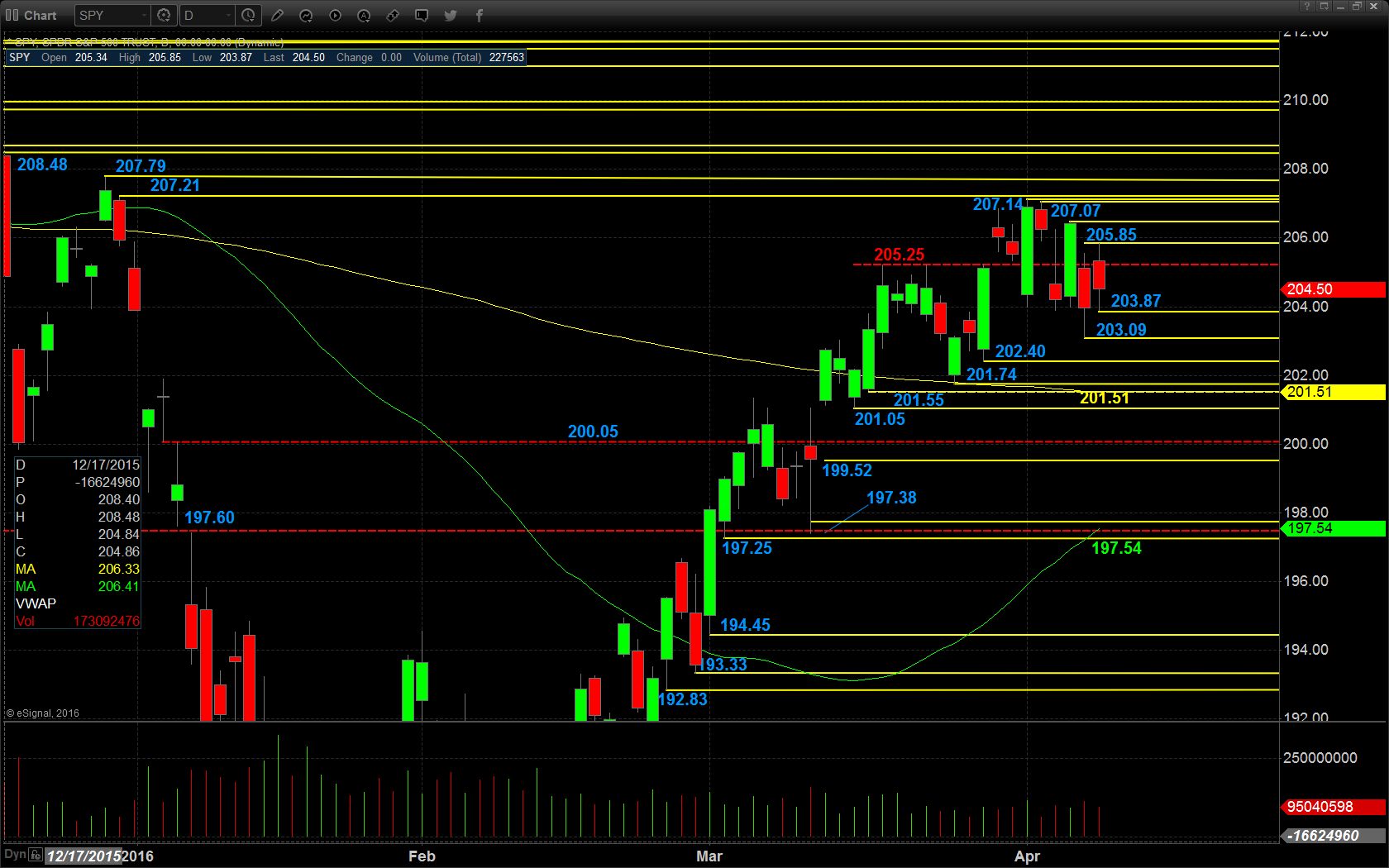

The SPY traded slightly lower in Friday’s session, closing out back below the critical support pivot. Support will lie at the critical support pivot at $205.25, followed by the low of Friday’s range at $203.87 and $203.09. Resistance will lie at the high of Friday’s range $205.85, followed by $207.07, $207.14, and $207.21.

Small Cap Watch List

*Please refer to the momentum scanners displayed live in the chat room for potential plays at the market open.

**Others On Watch**

$CAR

Economic Calendar

9:25 New York Fed President William Dudley speaks

11:00 USDA weekly grain export inspections

1:00 Dallas Fed President Rob Kaplan speaks

4:00 USDA Weekly Crop Progress

Notable Earnings Before Open

NONE

Notable Earnings After Close

AA: Alcoa – EPS Est. $.02, Rev Est. $5.14B

April 11th Swing Watch List

$SWIR – A nice move up off the lows following earnings. This has been testing the 15 area for awhile, and is now poised to go. Moving higher in a weak market and holding up EMA support, I like this back to 16 short term. Long is over 15, stop is 14.50.

$SGMS – A big flag struggling to break over the 200 EMA, but holding support. A small and speculative entry could be the ticket to this one. Looking for a move to 10.25. Lon entry will be over 9.50, stop 9.00, initially.

$DLNG – A BIG bull flag on high relative volume following a big week last week. The room here is to 12.75 and beyond in a hurry. Long will be over 11.60, then an add at 12.00. Stop is 11.25.

$MRTX – On short watch as this low volume mover has tapped and failed resistance multiple times, and now moves lower toward the 20 EMA support. Short entry will be under 21.69, stop 22.25. Room here is to 20 and then 19.

$PCRX – On reversal watch after a 9 day run for 35%. Forming a doji just under the 200 EMA here, this is ready to come in for a bit. Will look to short either at 62.36 or under 59.50. Room here is going to be down toward the 55.50 area. BIG mover/ATR, so size accordingly.