Wednesday April 13, 2016

Economic Calendar & Watch Lists 4/13/2016

Morning Notes

US futures are moving higher extending yesterday’s rally after stronger than expected Chinese trade data released overnight. European markets are trading sharply higher as well over +2.5%. China’s exports rose the most in over 1 year, hinting at signs of possible stabilization in China’s economy.

Technicals

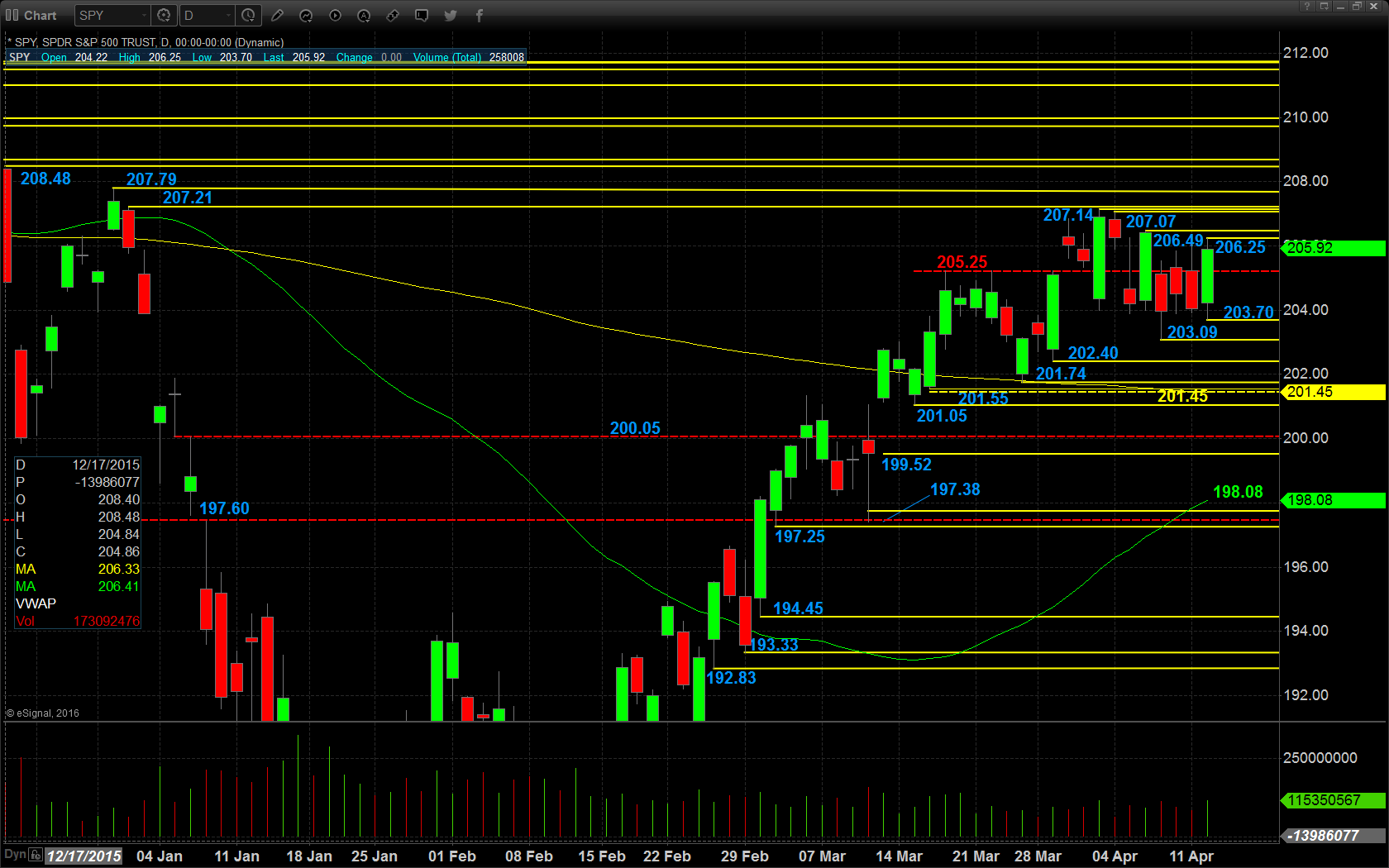

The SPY pushed higher in yesterday’s session and closed back above the critical, near term resistance pivot. The SPY is gapping up this morning into congested resistance levels. Resistance will lie at $207.07, $207.14, $207.21, $207.79, and $208.48. Support will lie at $206.49, $206.25, and $205.25.

Small Cap Watch List

*Please refer to the momentum scanners displayed live in the chat room for potential plays at the market open.

**Others On Watch**

$HOG

$JPM

Economic Calendar

8:30 Mar retail sales expected +0.1% and +0.4% ex-autos

8:30 Mar final demand PPI expected +0.2% m/m and +0.3% y/y

10:00 Feb business inventories expected -0.1%

10:30 EIA Weekly Petroleum Status Report

1:00 Treasury auctions $20 billion of 10-year T-notes

2:00 Beige Book

Notable Earnings Before Open

JPM: JP Morgan – EPS Est. $1.26, Rev Est. $23.4B

CSX: CSX Corp – EPS Est. $.50, Rev Est. $N/A

Notable Earnings After Close

NONE

April 13th Swing Watch List

$HUN – A nice multi top testing big, long term resistance under 14. Looking for a move back toward 15 or 16, short term. This is a liquid name with a smaller ATR, so I plan to size up. Looking for a long over 13.85, add over 14. Stop will be 13.50 and first target will be 14.60.

$XPO – On watch again after gapping away from us last time! Long is over 30.50 or so, stop 30.00. Room here is to 32 and then 34.

$NVIV – A nice consolidation along support after a sharp and BIG move up. Looking for another similar move. Long here is over 6.80, stop 6.38. Room here is to 7.75 and beyond.

$HUBS – This one is testing big support long term here. If it falls and market comes in, I expect a quick push lower. Looking for an entry under 39.00, stop 40.00. Room here is to 37.50 and then 36.50.