Monday May 2, 2016

Economic Calendar & Watch Lists 5/2/2016

Morning Notes

US Futures are relatively flat this morning while European stocks trade slightly higher as European April manufacturing was revised higher. Asian markets closed mostly lower. European and China markets are closed today for a Holiday.

Technicals

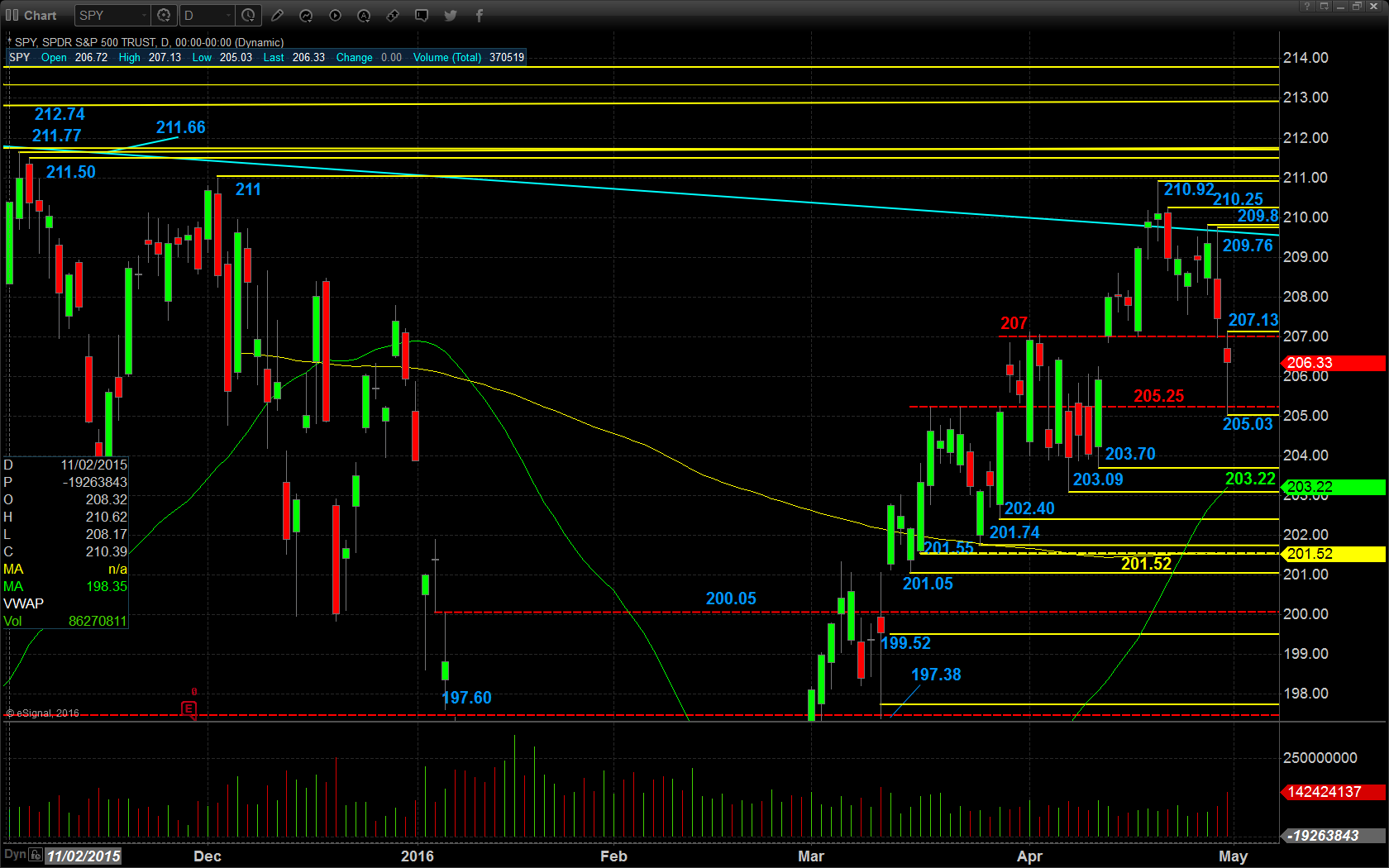

The SPY initially fell sharply lower in Friday’s session but managed to hold the most recent critical support pivot at $205.25. Support will lie again at the critical support pivot at $205.25, followed by the low of Friday’s range at $205.03. Resistance will lie at the new critical resistance pivot at $207, followed by the high of Friday’s range at $207.13, the high of Thursday at $209.76, and macro descending resistance at $210.

Small Cap Watch List

*Please refer to the momentum scanners displayed live in the chat room for potential plays at the market open.

**Others On Watch**

$GNC

$BIDU

$WYNN

Economic Calendar

8:50 Atlanta Fed President Dennis Lockhart speaks

9:45 Final-Apr Markit manufacturing PMI expected unch at 50.8

10:00 Apr ISM manufacturing index expected -0.4 to 51.4

10:00 Mar construction spending expected +0.5% m/m

11:00 USDA weekly grain export inspections

4:00 USDA Weekly Crop Progress

Notable Earnings Before Open

SYY: Sysco – EPS Est. $.42, Rev Est. $11.87B

DO: Diamond Offshore Drilling – EPS Est. $.28, Rev Est. $412.20M

Notable Earnings After Close

AIG: American International Group – EPS Est. $.99, Rev Est. $13.57B

APC: Anadarko Petroleum – EPS Est. $(1.19), Rev Est. $1.81B

May 2nd Swing Watch List

$PSG – A battered stock consolidating at the 20 EMA. Looking for a move to 4 and breakout beyond that. Long entry is over 3.77-3.80, stop 3.50. Target is 4, and then 4.50. Some insider buying has this creeping up.

$ALK – Dying a quick death after earnings, watching this to settle and bounce. Beware of the dead cat… This isn’t quite setup just yet, but looks good for a debit spread when it bottoms out.

$CNK – A sweet looking short setup here. Rolling over big thru the EMAs ahead of earnings. Short entry is under 34.20, add 34.00. Stop will be 34.65. Room is to 32.90 and then 31.50.