Wednesday September 13, 2017

Economic Calendar & Watch List

Morning Notes

US Futures and European shares are lower in early trading. Markets are pulling back slightly after two strong sessions. Weakness in technology stocks are weighing on the market, led by Apple (AAPL) after their iPhone release event yesterday. Financials performed well in yesterday’s session after the talks of tax reform. Asian stocks settled the day mixed.

Technicals

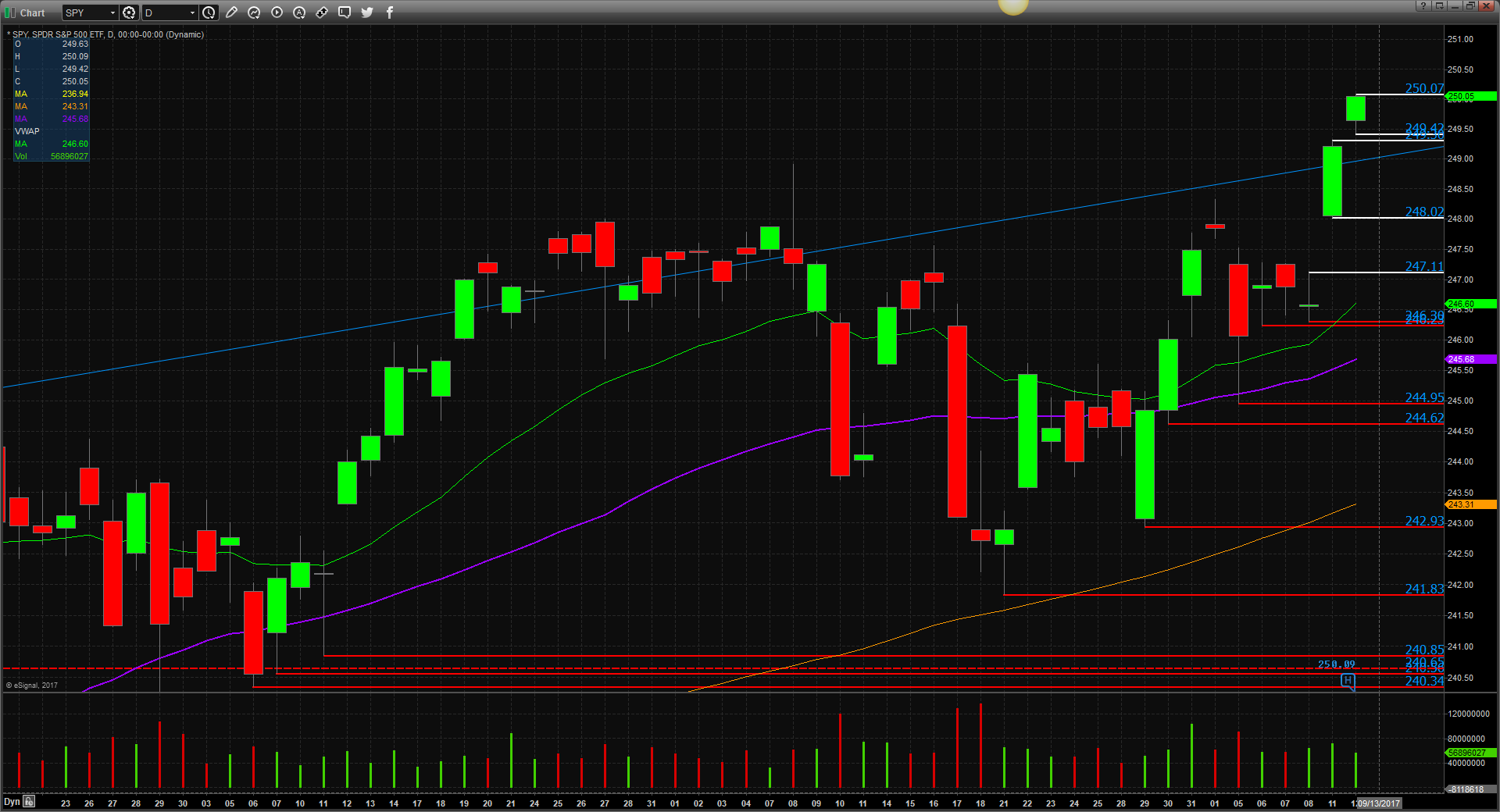

The SPY continued to show strength for a second day gapping higher and closing the session at new all time highs. Support will lie at the low of yesterday’s range and gap entry at $249.42, followed by gap fill at $249.30, then ascending resistance at $249.02, then another gap entry at $248.02, followed by another gap fill at $247.11, then the 20EMA at $246.55, then $246.30, $246.23, the 50SMA at $245.68, then $244.95, $244.62, and the 100SMA at $243.31. Resistance will lie at the high of yesterday’s range at $250.07.

Small Cap Watch List

*Please refer to the momentum scanners displayed live in the chat room for potential plays at the market open.

**Others On Watch**

Economic Calendar

1030 EIA Petroleum Status Report

Notable Earnings Before Open

NONE

Notable Earnings After Close

NONE