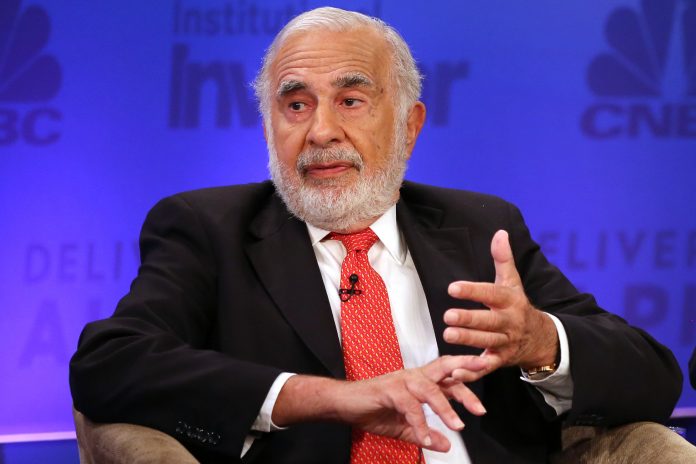

The drama surrounding one of the largest oil deals in recent history doesn’t seem to die. Billionaire and activist investor Carl Icahn has filed a lawsuit against Occidental Petroleum (NYSE: OXY) over it’s $55 billion takeover of Anadarko Petroleum (NYSE: APC).

Arguing that the company had severely overpaid for it’s rival and “botched” the acquisition, Icahn took a shot at fellow billionaire Warren Buffet, saying that he pushed a pricey financing package onto the company.

Icahn owns a $1.6 billion stake in Occidental and is fighting to gain access to documents relating to the takeover. He described the transaction on Thursday as being “fundamentally misguided and hugely overpriced,” adding that the deal was pretty much a massive bet on oil as well as and a cunning move from “one of history’s canniest investors,” in reference to Buffet.

Specifically, Icahn has invoked an obscure section of the Delaware corporate law code referred to as a 220 demand, where shareholders can request documents to investigate corporate mismanagement.

The billionaire added that Occidental had screwed up the financing by striking a $10 billion deal with Berkshire Hathaway, a move that will cost the oil giant over $800 million per year in dividends on preferred stock.

Icahn also took a shot against Occidental’s Chief Executive, Vicki Hollub, calling into question her lack of deal-making experience. “Unfortunately for Occidental’s stockholders, as shown by the terms of the Berkshire preferred [stock], a ninety-minute deal ‘negotiation’ with one of history’s canniest investors, is no place to gain M&A experience — at least if you care about protecting your stockholders,” read Icahn’s lawsuit.

Hollub defended the deal, saying that the agreement would be able to provide around $3.5 billion in annual savings for Occidental through cutting down on operating and capital costs.

However, even Occidental’s shareholders have expressed worries over how much was paid for the deal. In an earlier meeting in May, shareholders voted for a proposal that would make it easier for investors to organize opposition against the company’s board.

Analysts and experts have chimed in on the matter, saying that the Anadarko deal is pretty much irreversible at this point in time. That doesn’t seem likely to stop Icahn anytime soon, however.

Shares of both companies stayed relatively the same today, not moving much in response to the news.

Anadarko Petroleum Company Profile

Anadarko Petroleum, based in The Woodlands, Texas, is one of the largest independent exploration and production companies in North America.

Its asset base includes conventional and unconventional properties in the U.S. and deepwater oil and gas projects in the Gulf of Mexico and Africa. At the end of 2018, proven reserves totaled 1.47 billion boe, with net production of 666 mboe/d. – Warrior Trading News

Occidental Petroleum Company Profile

Occidental Petroleum is an independent exploration and production company with operations in the United States, Latin America, and the Middle East. At the end of 2018, the company reported net proven reserves of 2.8 billion barrels of oil equivalent.

Net production averaged 658 thousand barrels of oil equivalent per day in 2018, at a ratio of 77% oil and natural gas liquids and 23% natural gas. – Warrior Trading News