Tuesday April 5, 2016

Economic Calendar & Watch Lists 4/5/2016

Morning Notes

US futures are lower this morning by over -.75% while European stocks are trading lower by over -2% as fears about a weak global economy resurface after IMF Laggard’s comments. Asian stocks closed lower lead by Japan’s Nikkei closing at nearly 2 month lows.

Technicals

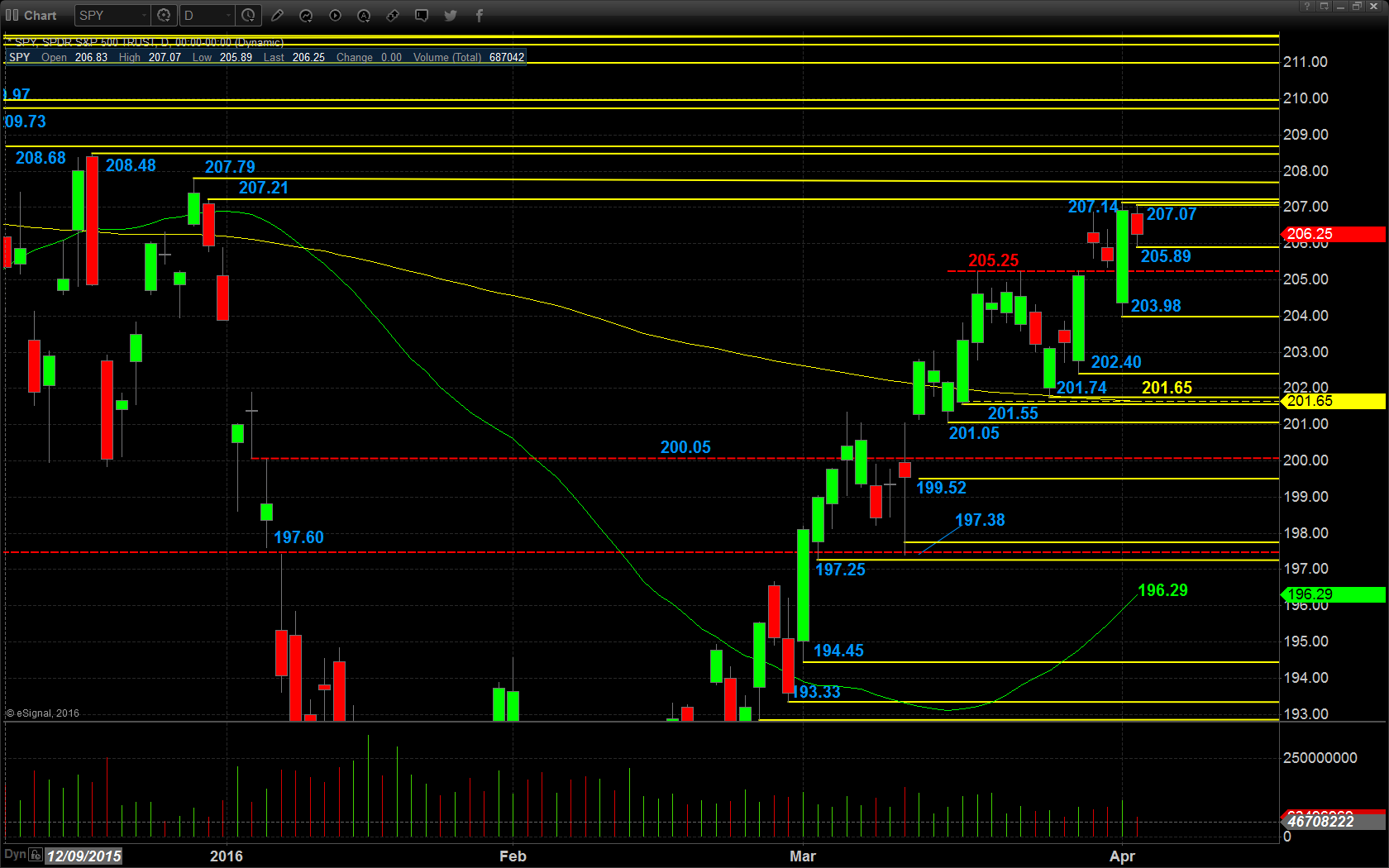

The SPY consolidated and traded slightly lower in yesterday’s session after Friday’s strong surge higher. The SPY is gapping lower this morning through a key level of recent support at $205.23 – $205.25. Support will lie at the low of Friday’s range at $203.98, followed by $202.40, $201.74, and the 200 day SMA at $201.65. Resistance will lie at the recent pivot zone of $205.23 – $205.25, followed by the low of yesterday’s range at $205.89, and then the high of yesterday at $207.07.

Small Cap Watch List

*Please refer to the momentum scanners displayed live in the chat room for potential plays at the market open.

**Others On Watch**

$ICPT

$NFLX

$FSLR

Economic Calendar

8:30 Feb trade balance expected -$46.2 billion

9:45 Final-Mar Markit services PMI expected +0.2 to 51.2

10:00 Mar ISM non-manufacturing PMI expected +0.8 to 54.2

10:00 Feb JOLTS job openings expected -53,000 to 5.488 million

Notable Earnings Before Open

$DRI: Darden Restaurants – EPS Est. $1.20, Rev Est. $1.84B

$WBA: Walgreens Boots Alliance – EPS Est. $1.27, Rev Est. $30.66B

Notable Earnings After Close

NONE

April 5th Swing Watch List

$AAVL – A cheap sideways biotech with nice room back up toward 6.50. If IBB wants to breakout and move higher, AAVL could follow suit. Long is over 5.50, stop 5.20. Add over 5.87 for the move to 6, then 6.50.

$IBB – Low IV and and nice upside range make this attractive for a quick hit and run trade. Looking at a May16 275/280 call spread for a debit of 2.10. Looking for 30-50% on this.

$EYES – A previous big runner, this nice bullish cross over the 20 and 50 EMA is a bullish confirmation of a move higher. Looking for an entry over 5.25-5.30, stop 5.00. Room is to 6 or so.

$TWX – A sweet bullish setup as the resistance under the 200EMA is being broken and the trend reads higher, just like the relative volume. Looking at a May16 75/80 Call spread for a debit of 1.50.

$ZG – Short watch for a breakdown under the EMAs. This has room below down to 21.85 short term. Short entry is under 23.50, stop 24.25. First target is 22.75.

$USO – Coming back down to our previous entry, this one is back on the radar. I have had MASSIVE success with long term trades on USO and will look to get back into it again.

$LM – A nice short opportunity as this financial is coming down on big volume, landing on big support after a nice run. If support fails at the 50EMA, this can flush quickly, especially in a weak market. Short entry will be under 32.95, stop 33.50. First target is 31.75, and then 30.60.