Commodity investors following the precious metals market will recall the earlier palladium bubble seen in Q1 2019. Spurred on by electric vehicle demand alongside diminishing supplies, prices for the rare metal surpassed gold, breaking the $1,550 per ounce before plummeting back down.

Since then, the precious metal saw another comeback in July, hitting a similar price point before giving background once again. Now, however, palladium prices have broken past there previous highs, reaching well into the $1,600’s.

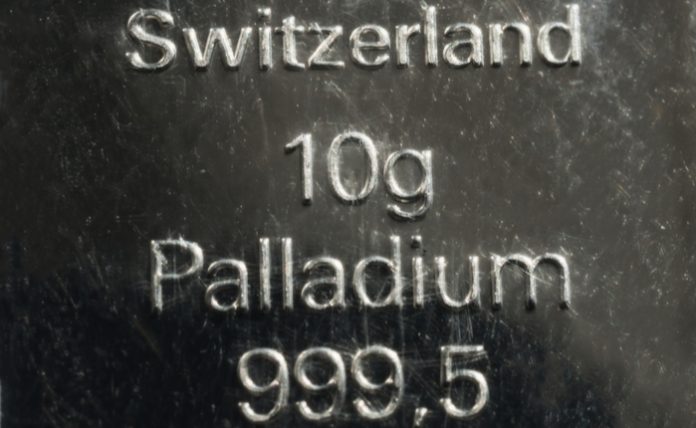

As of October 2nd, palladium is selling at $1,647.50 per ounce while on Monday, prices for the metal had surged to $1,700 per ounce, an all-time high. Although global auto demand has declined, which in turn impacts the demand for electric vehicles that use palladium in their batteries, prices shot up on news that China’s emission standards would be tightening.

“We struggle to see where the market might find material relief as demand continues to grow while supply remains constrained,” said UBS analysts according to The Financial Times. “That said, there is potential for the market to overshoot and be vulnerable during periods of risk-off, especially in the context of trade tensions and slowing global growth.”

Precious metals as a sector have been moving upwards in response to the growing worries of a potential recession. Coupled with the fact that trade tensions between the U.S. and China are continuing to fester and the recent attacks on Saudi Arabian oilfields, safe stores of value such as gold, silver, platinum, and to lesser extent palladium, have all become go-to places for investors.

While gold and silver have relatively little industrial use, palladium is different in the fact that it’s a crucial metal in electric vehicle batteries. As emission standards continue to become stricter, demand for EV’s and palladium is expected to continue to rise in the long run. This industrial demand is a major reason why analysts and speculators alike have been so bullish on palladium, more so than even gold.

So far, prices for the precious metal are up 32 % since the beginning of the year, making it one of the strongest performing commodities so far. As for gold, however, prices ended up falling a little. Settling around $1,466.45, gold prices haven’t been performing as well as some gold bulls had expected. However, prices for the yellow metal are still up 4% so far in the quarter.

Other precious metals like platinum and silver ended up falling a little as well. Platinum fell by 5.1%, sitting at $883.19 per ounce while silver dipped by 3% down to $17.01. Both metals have been trading near their 30- and 60-day lows. For the most part, precious metals as a group tend to be correlated, but gold and palladium tend to be the most volatile while silver and platinum tend to be more modest in their price swings.

With this new increase in price, people are once again on the palladium bandwagon. Now that a number of financial figures now suggesting that $2,000 per ounce is viable within the next three months, it will be interesting to see whether palladium’s high prices will remain or if they will fall back down just as before.