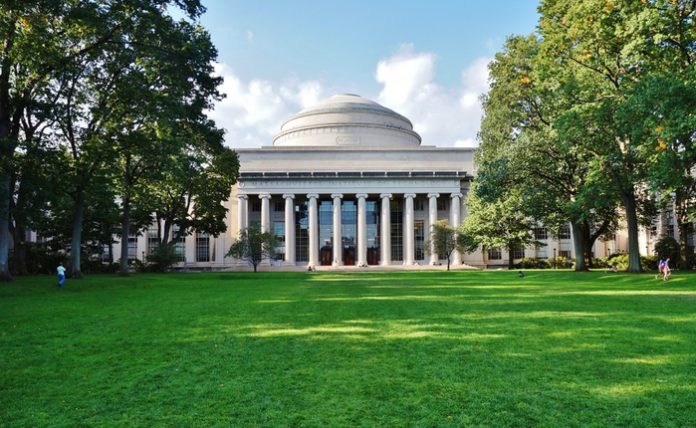

The wizards at MIT have devised an ingenious scheme – tech reporters are scrambling to cover the breaking story today that a new “Vault” cryptocurrency is estimated to be 99% more data-intensive than Bitcoin.

In other words, MIT researchers have put together a cryptocurrency option that allows the network to handle much less data for each individual transaction.

How does this breakout technology work? In a sense, it’s devilishly simple. It works by only requiring nodes to handle a portion of the original transaction information that has always been the underpinning of the blockchain model.

Think back to the early days of the blockchain, where experts were evangelizing its use to the world as an “immutable ledger” – the way they explained it was that you get decentralized consensus and transparency from everybody looking at the same data, the whole data set carved out of the “digital block of granite.”

So according to the general principle of lossless compression, it makes sense that you could shrink the amount of data necessary to verify transactions, and still have a working system. That said, it seems like it took until just now to figure that out.

“The Vault system is made speedy and smooth by ensuring that all empty accounts are removed and the transaction verification process is applied to only the most recent data, and not eons-old transaction information,” writes Rushali Shome today at BTCWires. “The result of the tests the new cryptocurrency was made to go through seems to have been extremely successful.”

“To speed things up, the researchers give each new certificate verification information based on a block a few hundred or 1,000 blocks behind it — called a ‘breadcrumb,’” writes Pranjal Mehar, also today, at Tech Explorist. “When a new user joins, they match the breadcrumb of an early block to a breadcrumb 1,000 blocks ahead. That breadcrumb can be matched to another breadcrumb 1,000 blocks ahead, and so on.”

In addition, Vault will use a proof-of-stake algorithm. The PoS option is, again, less data-intensive then a proof-of-work algorithm that, in a very common parlance, would require miners to ‘show their work’ like a second grader on a math sheet.

In a way, this is big news. Untethering blockchain from the mandate to deliver all of the information means that digital gurus can make cryptocurrencies and other blockchain technologies much faster and much more efficient. Will this move markets? Probably not today – and probably not tomorrow. But for those who are investing in traditional cryptocurrencies, it’s very important to know that big changes may be coming down the pike.